Student Banking Survey 2019: Results

UPDATE: View our 2022 Student Banking Survey.

You can’t get by at uni without a bank account – yet pick poorly and you’ll pay over the odds, or miss essential features. Our Student Banking Survey 2019 reveals if it’s time to get a better bank.

The Student Banking Survey 2019 digs into a crucial component in how well students manage their money: the banks.

This year’s survey was answered by 1,314 students - thank you to everyone who dished the dirt about their account, their bank and their money skills (or lack of them!).

Jaw-dropping stats this year include:

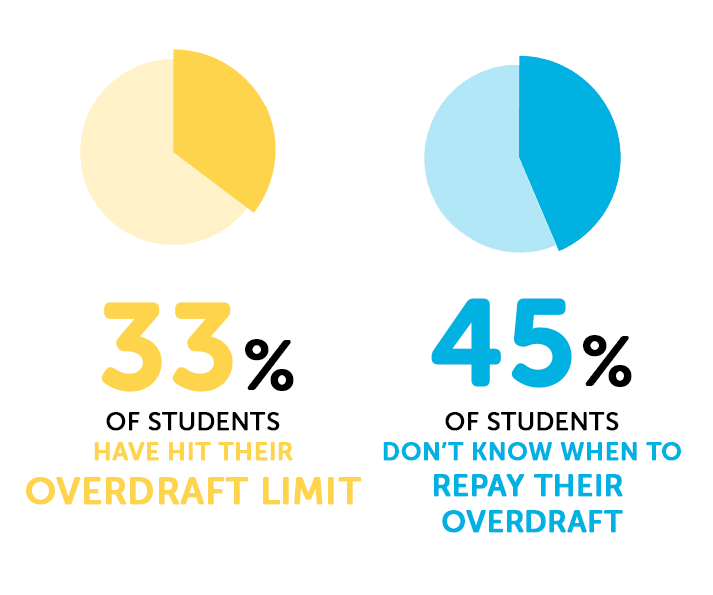

- 33% of students have spent their entire overdraft

- 45% don’t know when their overdraft has to be repaid

- Twice as many students use app-based banks than a year ago.

Read on for more insights, or to get a handle on student banking.

What’s in our report?

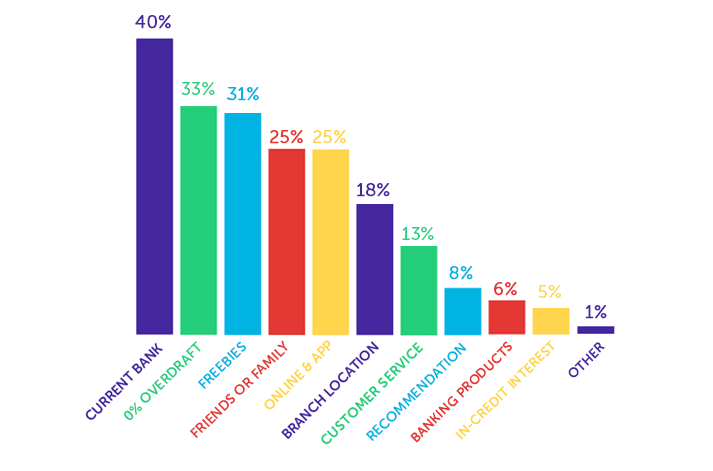

How do students choose a bank?

Since this annual survey kicked off in 2015, three top factors have consistently determined where students bank: the 0% overdraft, word of mouth, and freebies.

A student overdraft is one of the best perks out there: used properly, they save money and stress. You’re most likely to hear whether a bank is any good from friends and family, so personal recommendations are influential. And everyone loves a freebie!

First-year students really love freebies: 44% of them picked their account for the goodies. Once signed up, however, you’re likely to stick with your bank for the long haul - which is why the overall #1 factor in choosing an account for uni is that you already bank there.

It’s easy to be swayed by freebies, but don’t ignore other essential account features. Our guide to the best student bank accounts compares what’s on offer so you can get a proper look at them.

'Student' accounts come with extras designed for studying, so no surprise that 70% of students have one. If you can’t get (or don’t want) one of these, there are still regular current accounts, options for international students and digital banks to choose from.

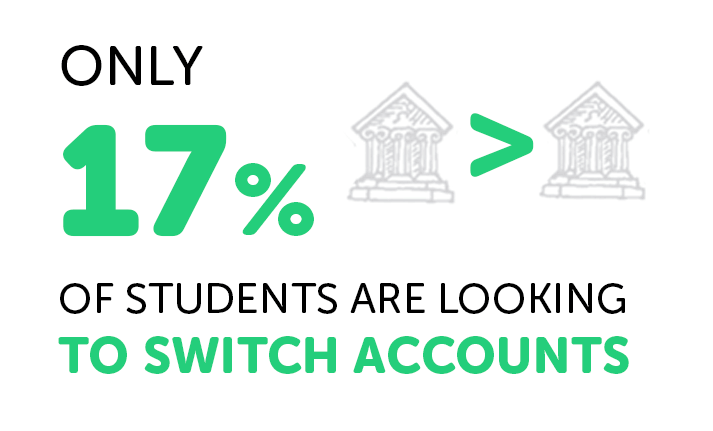

Are students savvy about switching?

Just 17% of students are thinking about switching bank – but is loyalty ever a good thing?

The honest answer is that lazy loyalty doesn’t pay. If you’re just sticking with your bank because you think it’s easier than moving, you’re probably missing out. Accounts are regularly updated, so review what’s on offer at least once a year (pop an alert in your calendar to remind you).

Top reasons to switch:

- Poor customer service

- Freebies or other rewards

- Larger overdraft or cheaper ways to borrow

- A better banking app or money management tools.

If you find a better deal, switching is simple. Your new bank will move direct debits, deposits and payments automatically within a few days, and will fix anything that doesn’t go to plan. Our Switching Q&A explains how it works - even if you have a student account or are overdrawn.

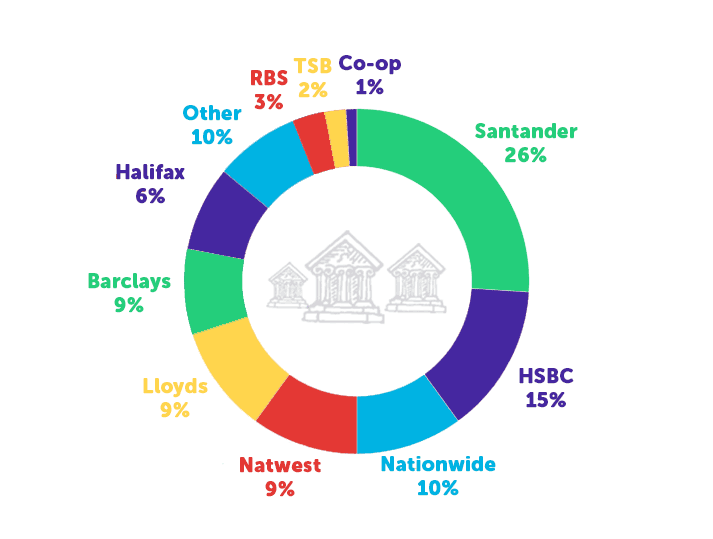

Which is the most popular bank with students?

1 in 4 students have a student account with Santander, making them most popular for the fifth year in a row. Santander offers some plump goodies – notably a 4-year railcard – but they also beat the other banks on customer service, too.

The Co-operative Bank is once again the least popular, though note that their student account can no longer be opened.

What about app-based banks?

One of 2019’s standout stats is that twice as many students now use app-based banks, rising from 16% in 2018 to 34% in 2019.

Almost 1 in 5 students bank with Monzo, though for most this isn't their main account (none of the digital banks offer ‘student’ accounts yet). Instead, savvy customers are making the most of budgeting and saving tools or cheaper holiday spending alongside traditional accounts.

This doesn’t mean students always prefer high tech, however: 98% still use cash (just not every day).

Student satisfaction scores

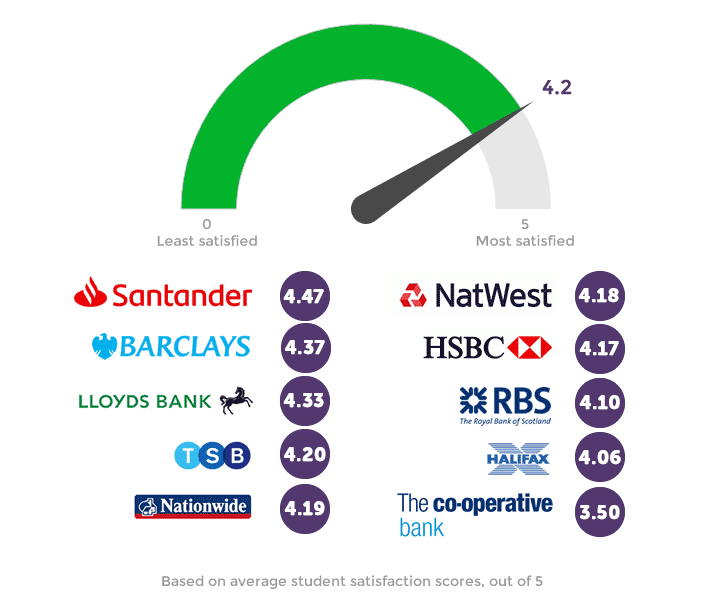

The good news is that most banks do well on student satisfaction, though it’s going to take some beating to knock Santander off the perch (they’re at the top so often they’re pretty much nesting there).

The average satisfaction score is 4.2 out of 5, with most banks scoring either slightly above or below that. Again, note that the outlier – the Co-operative Student Account – has been withdrawn.

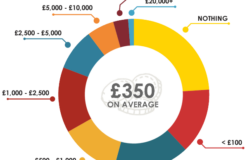

Student borrowing

For most students, uni life isn’t possible without borrowing – but how wise are undergrads about taking on debt to pay for living costs?

Incredibly, almost half of those with an overdraft don’t know when the money has to be repaid (45%, up from 35% in 2018). This is an error that could come back to bite so, ideally, you want to start a repayment plan in your final year to avoid unnecessary interest or stress.

Most students (69%) haven’t checked their credit score in the past year, either. Remember: switching is an easy way to profit, but you won’t get the full benefit if your credit score holds you back.

Also concerning is that a third of students with an overdraft facility have hit the spending limit at some point. This suggests that living costs are too high to handle, and/or budgeting skills aren’t always up to scratch (the National Student Money Survey 2019 confirms both of these are true).

Finally, more students are borrowing on credit cards (15%, up from 13% in 2018). Credit cards - as with overdrafts - are solid money tools, but you have to learn how to use them to profit from their strengths.

Our take on this? If you need a bank account at uni, make this the year you dig into how they work: used properly, overdrafts, credit cards and other account features don't have to cost you a bean. Get your hands on top money tools or the 5-minute cheat sheet if you need a boost.

About the Student Banking Survey 2019

- Want to know more about the survey, or need case studies, comments or quotes? We’re happy to help – just drop us a line

- You’re welcome to reference or re-use data from the survey with credit and a link back to this page: "Source: Student Banking Survey 2019 / www.savethestudent.org"

- Survey polled 1,314 current or recent students in the UK between 10th July - 1st August 2019.

![What do students spend money on? [stats]](png/what_students_spend_money_on2-252x160.png)

![What do students spend money on? [stats]](png/what_students_spend_money_on2-100x100.png)