Student Finance guide 2024

Student Finance got your head in a spin? Let us put you straight. We'll show you where the money is, how it works, how much you can get and how to get your hands on it.

Are Student Loans really all that bad? Actually, what even is a Student Loan? How will it impact your studies and your future? Is it even worth going to university anymore?

The chat surrounding Student Finance has all got a bit out of hand. Get to the facts and you'll find it's all quite straightforward, affordable and accessible.

And facts are what this guide is all about. Yes, Save the Student has campaigned against tuition fees for years, but we're even more passionate about debunking the myths that stop young people from following their dreams of going to uni in the UK.

How to use this guide

You don't have to read everything, or try to digest it all in one go:

- Only got a minute? Get the Student Finance essentials in 30 seconds

- Got five minutes? That's enough to get answers to the big questions

- Want it all? Keep reading for juicy details about real costs, hidden funding, and the truth about Student Loans.

Read what you can now and bookmark the page to pick it up later if you're short of time!

What's in this guide?

Student Finance in 30 seconds

- Student Finance (funded by the government) helps students from any financial background to go to university.

- The Student Finance package includes a loan for course fees, plus a means-tested Maintenance Loan or Grant to cover living costs.

- Universities can charge up to £9,250 a year in tuition fees, but you'll pay nothing upfront if you're eligible for Student Finance in the UK (most students are).

- You could get extra cash if a health condition, childcare costs or clinical placements leave you out of pocket while studying, or financial support if you're struggling to get by.

- You or your parents may be expected to chip in for maintenance support (i.e. living costs). You'll need to plan for this!

- Student Finance has to be paid back, but don't let that put you off. Student Loan repayments work more like a graduate tax, which is far easier to manage than normal loan repayments.

- You only make Student Loan repayments once you've left your course AND are earning enough. Repayments vary with your salary and stop altogether if your income drops too low.

- The Student Loan currently charges 7.6% interest.

- But crucially, many loans may be written off anyway before they're fully repaid. If you're not a big earner after uni you may only pay back a fraction of what you borrow from Student Finance.

- For the most part, Student Finance is reserved for UK students, but some exceptions apply.

- Almost all students can get a bite at funding beyond Student Finance, from bursaries and scholarships to charity and corporate cash.

Student Finance FAQs

What is the 'Student Loan'?

Student Finance in the UK includes a mix of grants (which don't have to be repaid) and loans (which you do pay back). Your Student Loan is all the repayable funding you apply for – that is, the Tuition Fee Loan and/or Maintenance Loan.

Bear in mind that you may have to repay some grants and extra funding as well if you leave your course early: always get advice before dropping out.

How much are tuition fees in the UK?

Most universities charge £9,250 a year for course fees. However, universities in Northern Ireland, Scotland and Wales often charge less (or nothing) to students who already live there, are from the Republic of Ireland or are from the EU and started their course in or before the 2020/21 academic year. Unfortunately, international students almost always face higher fees.

The good news is that most students from the UK can apply for Student Finance, scholarships or fee waivers, all of which make it easy to cover tuition costs.

How much Student Finance will you get?

The Tuition Fee Loan lets you borrow enough money to pay course fees in full, up to £9,250 a year (or about £6,000 a year at private unis). How much Maintenance Loan you get for living costs depends on your household income and where you live while studying.

How much you can apply for depends on where you're studying and what your household income is, though there's a bit more on offer if you study in London or spend part of your course abroad. Many students will get less than the maximum, so it's important to check for yourself.

Your funding package may also include support for physical or mental health conditions, or cash for parents and carers: payouts for these vary.

Who can get Student Finance?

There are almost as many rules about who can get Student Finance as there are Subway sandwich combos.

At its simplest, you should be eligible for tuition AND maintenance support if you're studying an approved course at a registered uni and haven't previously started a degree or similar course.

You'll also need to be a UK citizen (or have 'settled' status) and have been living here for at least three years before your course start date.

While Irish students, and those from the EU who started their course in or before the 2020/21 academic year, can apply for the Tuition Fee Loan, they won't usually get help paying living costs.

Rules and amounts also vary if you're a part-time student, over 60, at a private uni, or claiming special circumstances such as refugee status. Contact Student Finance to flesh out the extra details for yourself.

What else do students have to pay for?

Tuition fees may hog the headlines but, for most students, the key to surviving at university is planning for living costs.

These include monthly rent, food, transport, textbooks, and anything else you need to stay alive and on top of your studies.

The average student spends £1,078/month at uni, though there are ways to pay less or find funding.

When should you apply for Student Finance?

You can start applying for Student Finance in the spring before your course starts. You don't need a confirmed place, so get in early to be paid promptly at the start of term. You can apply as late as nine months after starting, but don't wait if you need the money.

Either way, allow time to get your paperwork together, plus at least four to six weeks to hear a decision. It's not as long-winded, but you'll also need to reapply for funding each year of your course.

We also have all the Student Finance deadlines you need.

What funding is available if you can't get Student Finance?

Universities offer a mix of scholarships, bursaries, fee waivers and hardship (emergency) funds. Some charities, companies, councils and professional bodies also award grants and financial support: it's possible to dig up hidden funding for everything from spiritual or ethical beliefs to what your parents do for a living.

If you can't get (or don't want) Student Finance, make sure your salary, savings, family support or other finance is enough to cover the cost of uni.

Will tuition fees change?

Tuition fees have been frozen for the last few years, but in 2017 they increased from £9,000 to £9,250 a year – even affecting students who had already started their courses. However, even if tuition fees jumped up to £100,000 a year, it wouldn't increase the amount you'll repay every month.

Monthly loan repayments after uni are determined by your salary, not by how much you borrow.

Will bigger loans lead to more student debt?

While Student Finance helps pay for university, it does usually mean you'll graduate owing thousands. But, because of the way repayments work, in reality, many students will only pay back a small part of what they borrow.

Use your predicted graduate salary and monthly repayments to see if the loan is right for you, rather than fixating on what you'll owe. In the meantime, you absolutely do need a plan to deal with everyday debt such as student overdrafts, credit cards and other kinds of borrowing.

Can you afford university?

Only you can decide if university is affordable for you. There's a lot of funding out there, some of it ring-fenced to ensure poorer students aren't left out.

That said, almost everyone finds it easier with extra income or family support, as many students struggle to get by on Student Finance alone.

However you play it, a money plan is a must!

How to contact Student Finance

To apply for Student Finance or ask how much you'll get, contact the agency where you live (or where your uni is located if you're not from the UK):

England

Phone: 0300 100 0607

Twitter: @SF_England

Website: Student Finance England

Northern Ireland

Phone: 0300 100 0077

Website: Student Finance Northern Ireland

Scotland

Phone: 0300 555 0505

Twitter: @saastweet

Website: Student Awards Agency Scotland

Wales

Phone: 0300 200 4050

Twitter: @SF_Wales

Website: Student Finance Wales

How much does university cost?

Tuition fees in the UK can be anything from free up to £9,250 per year. We have a full guide on how much university costs with more information, but it's important to remember the price of your tuition will depend on where you're from in the UK and where in the UK you'll be studying.

Fees are also likely to be very different for international students (which, as of the 2021/22 academic year, includes students from the EU, excluding Ireland), as there's no official maximum figure. Either way, check the university's website or prospectus for details or see the UCAS course catalogue.

How to pay for university

Tuition Fee Loan

Apply to: Student Finance

Eligible full- and part-time students can borrow for the full cost of their course fees, up to £9,250 per year (or up to £6,165 a year at private universities). This money isn't means-tested, so household income won't affect how much you get.

The maximum amounts apply to students from across the UK who study in England. This means if you're from Wales and opt to study in England, you'll get enough to cover the higher fees. However, you can't borrow a bit extra on the side with this loan: it's only for course fees and is paid directly to your university.

If you don't take the Tuition Fees Loan, you'll need to make your own arrangements to pay tuition, either in full or in instalments.

If you're a Scottish student studying in Scotland, note that even though you'll likely be eligible for 'free' tuition, you'll still need to apply to Student Finance to ensure you don't get charged.

Living costs

Maintenance Loan

Apply to: Student Finance

The Maintenance Loan pays for day-to-day living expenses like rent, bills, food and books. Unlike the fees loan, it's paid directly to your student bank account once a term (monthly in Scotland) and you can spend it on anything you like – which is why you need to be clever about it.

The Maintenance Loan is partly means-tested. Everyone eligible can get some of it regardless of their financial situation, but to get the full allowance, you'll need to declare household income. For most students, that's how much their parents earn.

Maintenance Grant

Apply to: Student Finance

Maintenance Grants are the golden ticket of Student Finance because – unlike loans – you don't have to repay them. How much you get depends on your household income and where you're from:

- Students from Northern Ireland can get up to £3,475 a year.

- Students from Wales can get at least £1,000 a year, up to a max of £6,885 if they live at home, up to £8,100 if they live away from home, or up to £10,124 if they live away from home and study in London.

- Students from Scotland can receive the Young Students' Bursary of up to £2,000 a year.

New starters from England can't apply for the Maintenance Grant anymore. You're now expected to take out a larger Maintenance Loan instead. If you started your course before 2016 and already get a Maintenance Grant, don't panic: your funding will continue as long as agreed.

Special Support Grant

Apply to: Student Finance

In Wales and Northern Ireland, some students with lower household incomes may be able to swap the Maintenance Grant for a Special Support Grant (SSG). You could be eligible if you receive certain benefits, qualify for Disabled Students' Allowance or are a single parent.

SSG pays up to £3,475 a year in Northern Ireland, and up to £5,161 a year in Wales. Just like the Maintenance Grant, it's means-tested and doesn't have to be repaid. Unlike the regular grant, it won't reduce the amount of Maintenance Loan you can apply for, and won't affect any benefits you get either.

Making the most of maintenance funds

- Maintenance funding is doled out in regular instalments, but you'll need to make it last between payments. Rent or freshers' week can hoover up an entire loan, so plan ahead!

- You need to register for your course before funds are handed over. That means you'll get to uni before receiving your loan, so bring cash to keep you going in the meantime.

- Including untaxed income in your household income assessment (such as some savings interest/state benefits) could mean you get a smaller Maintenance Loan – our student tax tips explain how to work it.

- You can ask to be reassessed for funding if your household income drops significantly during your degree – keep it in mind.

Bursaries and scholarships

Apply to: your university

Almost all universities offer a selection of student bursaries. These are cash gifts you usually don't have to repay.

Bursaries typically go to students whose household income is below £25,000 a year, though some universities cut off at around £40,000 a year. There may also be awards for students leaving care, refugees, and those who financially support or care for others. Payouts vary from book tokens and one-off awards to annual payments of £1,000 or more.

Scholarships reward talents or achievements such as exam grades, music and sport. Some universities also offer incentives to study particular courses, or could be available to students from specific countries. Scholarships can be cash awards or tuition fee waivers (if you're given a choice, cash is the better deal!).

Your own money

Any cash you bring to the table will make uni life a lot easier. Start stuffing money into a savings account before you start your course if you can – even a few quid here and there adds up.

If you can work while studying, here are some ways to make some extra cash:

Parental contribution

Some Student Finance maintenance funding is means-tested, so how much you get depends on your household income. If you're financially dependent on your parents, that means their income affects your funding.

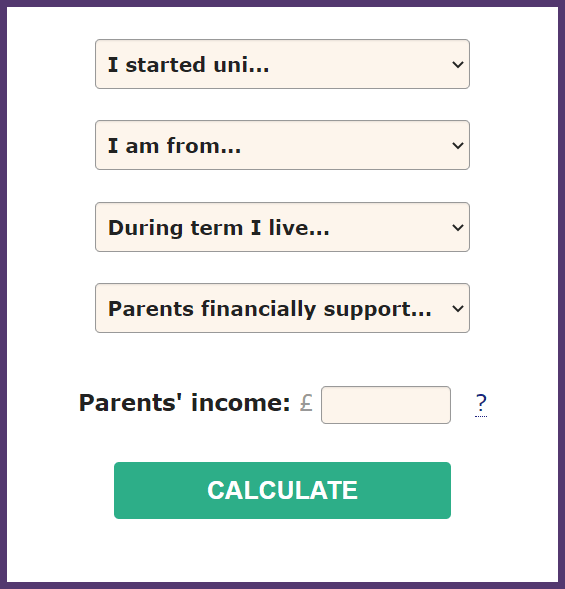

Crucially, the more your parents earn, the less Student Finance you'll get, because the government expects them to contribute as well – this parental contribution calculator reveals how much:

In reality, many students feel guilty about asking, don't ask at all, or are left short because their parents can't help. It's definitely awkward, but it's a conversation you need to have with your folks sooner rather than later. Consider the following questions:

- Can your parents afford to help you?

- Do they have any conditions about how you spend the money?

- Will you have to pay them back?

- If they can't help financially, how else could they support you? Don't underestimate the power of leftovers!

Show them our parents' guide to university if they need more info to make a decision. And, if you'd like more advice about asking your parents for money at university, our guide can help.

Borrowed cash

Apply via: student banking

Borrowing without a plan is like jumping out of a plane with a handbag instead of a parachute: it won't end well.

A 'plan' means thinking about why you're borrowing, comparing options (credit card, loan, overdraft, saving up), checking the total cost, and planning for repayments.

An interest-free overdraft is one of the best picks for students. Used the right way, they let you borrow cash for free (unlike commercial loans). Use them poorly, however, and you lose the benefit.

Start with our student overdrafts explainer, then pick the best student bank account for your needs.

How to budget for university

For many students, uni is the first time they've lived away from home, which includes paying for things like bills and groceries. Creating a budget whilst at university will help you get a grip on your finances. By listing all your monthly income and outgoings, you'll be sure to never spend more than you should.

If you're unsure where to start, you can download our budgeting spreadsheet or use a budget tracker to make things easier.

Extra sources of funding

Credit: NoHoDamon - Flickr

Support for parents and carers

Apply to: Student Finance

If you're responsible for looking after someone else while studying, you could be in line for extra cash. The funds below cough up £1,000s each year, though your payout will depend on your household income. Once you get the cash, it's non-repayable.

- The Parents' Learning Allowance awards cash to students with dependent children. In Scotland, it's a Lone Parents Childcare Grant – i.e. for single, widowed or divorced parents.

- As you might expect, the Childcare Grant helps pay for a childminder, nursery or other childcare fees. In Scotland, money is handed out directly by the university and is a limited pot – so you'll need to apply early.

- An Adult Dependants' Grant provides cash support if you're financially responsible for another adult, for example, as a carer. Awards are means-tested, either by your household income or the person you look after.

While these funds are mostly for full-time UK students, who can claim (and how much) varies around the country. Cash is bundled in with Student Finance, so you'll need a UK bank account to get paid.

Disabled Students' Allowance (DSA)

Apply to: Student Finance

If you have a disability that causes you extra costs while studying, you could get DSA. 'Disability' includes mental health issues, unseen conditions (like epilepsy) and learning difficulties (such as dyslexia) as well as long-term physical conditions. There's funding to pay for specialist equipment, a non-medical helper and travel expenses, plus a general allowance.

The amount you could be entitled to will vary depending on where you are based in the UK, but DSA isn't means-tested and doesn't need to be repaid. Accepting other disability-related grants or support can affect whether you get DSA, so talk it over with your uni or Student Finance office first. Check out our comprehensive guide to DSA for more in-depth advice and info.

Depending on where in the UK you're from, the amount of DSA you could be entitled to will vary – but in each country, the maximum amount is over £20,000 a year.

Other funding

Apply to: various

Here are some additional forms of student funding that are worth looking into:

- There are bursaries and scholarships beyond those handed out by universities, along with specialist scholarships most students never hear about.

- If you're studying for a healthcare-related degree (including medicine), you could be eligible for an NHS Bursary.

- Travel grants are up for grabs if you study part of your course abroad, or you're a medical or dental student and have clinical placements in the UK. Contact Student Finance about these.

- Universities usually oversee bursaries for care experienced students, but in Scotland, a bursary and accommodation grant is handled by SAAS.

- Crowdfunding (asking strangers to invest in you) is an option if you have a good story to tell.

- The Turn2us grants checker lists charity funds you may be eligible for.

- If you're taking time out from a job (and expect to go back after uni) talk to your employer about cash support or sponsorship.

- Most students can't usually get benefits but check for yourself if you have special circumstances or are really struggling. Our guide to Universal Credit and Jobseeker's Allowance should be able to help.

A sponsored degree, where a company pays for your studies, is a sizeable commitment rather than a bit of extra cash. You may be expected to work for them during and after your studies, in exchange for wages plus (often generous) study-related expenses.

You might need to sift through several company websites (try their recruitment pages) to track down opportunities. Alternatively, ask your careers adviser or search online for 'Degree Apprenticeships'.

Emergency money

Apply to: various

If you run out of cash after starting your course, ask your university or students' union about hardship funds (emergency grants or loans for students).

Each uni sets its own criteria for who can apply and how much they'll get. They may also want to see copies of your Student Finance letters and your budget before handing over any cash.

Also, learning the right way to use a student overdraft could save your bacon in a crisis.

Student Loan repayments

Credit: bbernard – Shutterstock

Here are the key things to know about Student Loan repayments:

- You only start repayments when you're earning enough – Student Loan repayments won't kick in until the April after you left your course and you earn above a certain threshold. The repayment thresholds differ by country, so make sure to check what plan you're on.

- You only pay 9% of your earnings over the threshold – If you start earning above the threshold, you don't make repayments on your full salary. Instead, you pay 9% on anything you earn above the threshold. You can use our Student Loan calculator to get an idea of how much you'll be paying back.

- Interest is being added all the time – Even though you won't make repayments until you earn over a certain threshold, interest is constantly being added.

- Repayments are taken from your wages – When you earn above the threshold, repayments are automatically taken from your wages before you get paid. The calculation will be shown on your payslip. If you're self-employed, you'll make repayments along with any income tax you owe by filling out a self-assessment tax return once a year.

- Student Loans are eventually written off – You'll carry on making monthly repayments (as long as you earn above the income threshold) for 25, 30 or 40 years, until either you pay back the whole amount or the loan is cancelled.

- The repayment terms can change – The terms of your Student Loan can be changed, even after you've signed the contract. This includes the interest rates, thresholds and loan wipeouts.

Student Loan small print

Remember: it doesn't matter how much you borrow, or what happens to interest rates. The only thing that affects the size of your monthly repayments is how much you earn after uni.

'Income' includes more than salary

Your income after graduation decides how big your Student Loan repayments are each month.

You're probably used to thinking of this as wages from a job, but it also includes other sources of taxable income, including bar or restaurant tips and some state benefits. It's worth keeping an eye on these, as they could nudge you over the salary threshold when you're not expecting it, or bump up your payment amount during some months.

A Student Loan WON'T affect your credit rating

Your credit score is a really valuable number that determines whether you get the best deals on credit cards, loans, energy bills and even mobile phone contracts. Thankfully, owing money on a Student Loan won't affect your credit score.

However, because monthly repayments come out of your wages, it could have a small effect if you apply for a mortgage later on (as banks use take-home pay to see how much you can afford to borrow).

Student Loan repayments don't stop if you leave the UK

Moving abroad after uni – whether for a few months or for good – doesn't mean you can forget about your Student Loan!

Living or working overseas may change your income threshold, so you'll still need to stay in touch with the Student Finance office and keep up with repayments. Our guide to repaying your Student Loan from abroad explains what to do.

You need to stay in touch with Student Finance

Like a particularly nosy relative, your Student Finance office wants to know what's happening with you. You'll need to tell them about obvious changes like your phone number, address, household income and bank account, as well as less obvious life events like getting married, moving abroad or working for yourself.

Not updating your details may mean missing out on funding at uni or, if you're overpaid, having to pay back the extra. Not replying to emails or passing on info after uni could mean being charged higher interest rates or even penalty fees.

Repaying early could be more expensive

You can choose to clear your student debt or make higher repayments at any time. This might be tempting if you want to be free of your loan ASAP, but it's usually only worth it for higher earners (i.e. those with a starting salary above £30,000).

For everyone else, it could mean paying back more than if you'd let the loan run its natural course. Plus, once you funnel extra money towards your loan, you can't get it back later on (i.e. if you're skint or want to spend it on something else). Think it over carefully and only pay up when you can afford to.

Warning: The terms aren't set in stone

We touched on this earlier, but it bears repeating: the Student Loan's terms can be amended even after you've signed the contract. Interest rates are the obvious example, but the earnings threshold and even the point at which the loan is wiped can be tweaked or dropped at will.

Notably, the government has previously backtracked on a promise to increase the salary threshold to take the pressure off repayments and only reverted to the original agreement after a lot of noise from Save the Student and other campaigners. However, they have since performed another U-turn and have frozen the threshold again.

It's impossible to know exactly how political gestures like this will play out. In the meantime, we'll always report what's going on and keep this guide updated.

You may have to repay grants if you drop out

Each year, some students will find uni just isn't the right call, or that money or personal issues make it impossible to carry on. If that's you, don't throw in the towel until you've talked it over with a uni advisor or the Student Finance team.

In particular, be clear about if and how you have to give back any non-repayable funds, such as grants and bursaries. Dropping out may also impact your chances of getting Student Finance again in the future.

Another reason you might have to repay free funding is if you bodge the numbers on your application (or don't update your details) and end up getting overpaid – keep an eye on it!

5 ways to reduce student debt

Credit: Pormezz – Shutterstock

Here are some final top tips to cut down your student debt:

- Find hidden funding – Hundreds miss out on free money each year because they don't know it's there or assume they're not eligible – yet almost all students have a shot at extra funding.

- Avoid unnecessary borrowing – When you can afford to pay it back, borrowing is perfectly safe. But it's very easy to slip up, so don't touch credit cards, private loans or even a 0% overdraft without a plan. If you're using credit to cope with hardship or cover up other debts, read our guide to managing debt at university first.

- Make cash alongside your degree – A job at uni can be a game-changer, as it's good for your CV and your bank balance. Search for a part-time job or try these making money ideas.

- Don't lose out on tax – Students often overpay income tax or under-claim Student Finance. Our five-minute read on student tax tips will help you get what's yours.

- Be savvy with your money – No matter how much money you have coming in if you treat it like a bottomless refill. Always plan how to spend your wages, then make the most of every single pound by paying less for everything.

Now you've got your head wrapped around Student Finance, see what other student funding you may be able to bag to support your studies.