Student Money Survey 2019 – Results

UPDATE: View our 2023 National Student Money Survey.

Heading to university? No need to guess how much money you'll need: the National Student Money Survey 2019 reveals exactly what to budget for study and living costs. 👀

The National Student Money Survey isn’t us just being nosy once a year. It’s your chance to get under the skin (and past the hype) of going to university, so you can make sound life decisions.

Now in its sixth year, our 2019 survey polled 3,385 students. That makes it the UK's largest independent survey of its kind.

The volume and range of comments we received is testament to how much students want a say in fees, finance, wellbeing and making ends meet at uni.

Save the Student is fearlessly impartial. Our stats go to places prospectuses can't. Use this page to get the full picture about the costs of university and hear honest insights from real students.

What's in our report?

- What's it like living on a student budget?

- Does Student Finance stretch far enough?

- Where do students get money from?

- The truth about adult work at uni

- What do students spend their money on?

- What are the cheapest universities?

- Do students understand their Student Loans?

- Is university good value for money?

- Life after university

- Expert comments on our findings

What's it like living on a student budget?

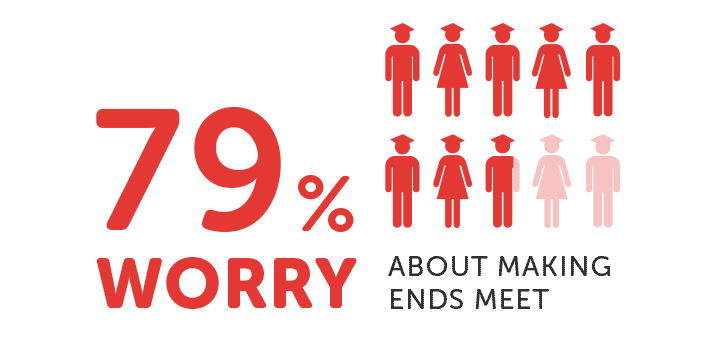

Student life and money go together like chips and gravy: it’s great when it clicks, but tough to stomach when it doesn’t. Unfortunately, this year’s National Student Money Survey reveals that more students than ever before are struggling to make ends meet – and the stress is very real.

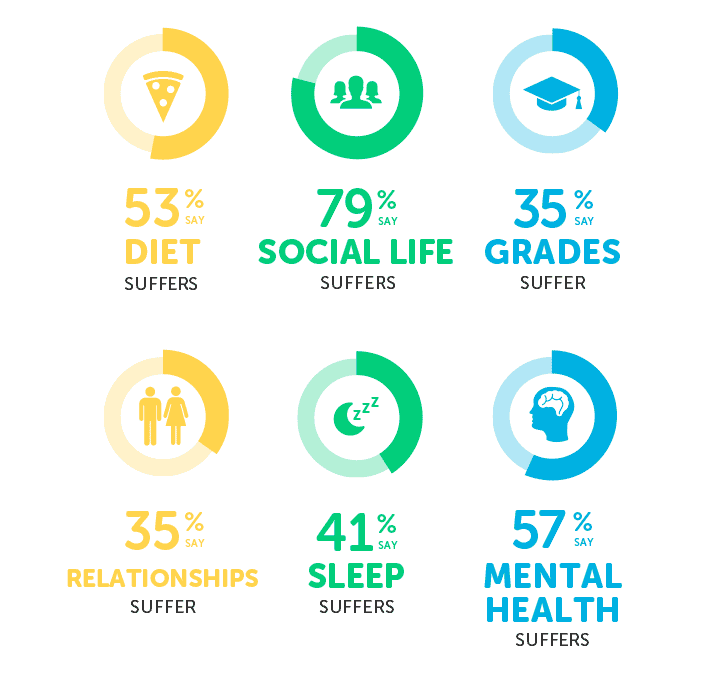

Loads of students worry about money, but what does that really mean? One way of putting it into context is to compare the consequences of being skint: how does worrying about money affect diet, sleep and mental health?

As you’d expect, most students start by cutting back on socialising when money’s tight. This is an obvious place to start, but if you don't swap-in free social activities, you could feel isolated, with nowhere to let off steam away from studying.

Crucially sleep, socialising, relationships, diet, grades and mental health are all connected. For instance, worrying about money might disrupt your sleep, which then affects your grades, which further knocks your mental wellbeing.

Well over half of all students say being skint is bad for their mental health. Why is the number so high? The evidence suggests it’s because there isn’t enough funding or support on offer. We get into the details of that below.

What students say about living on a budget:

- I’ve been lucky with a bursary although I know people that don’t eat properly.

- I have about £3.50 a day to budget for food. It really gets me down when all my friends want to do fun activities, eat out etc. I feel like I miss out on so much.

- I constantly felt like the university was asking us to spend more on materials, travel, projects, exhibitions and printing, all whilst telling us that if we budgeted well it would be manageable.

- It's crap and really hard and I've considered dropping out many times as I'm constantly broke and tired!

- Why do you think so many of us suffer from mental health issues, or abuse drugs and alcohol? I have no idea how so many students cope financially.

Does Student Finance stretch far enough?

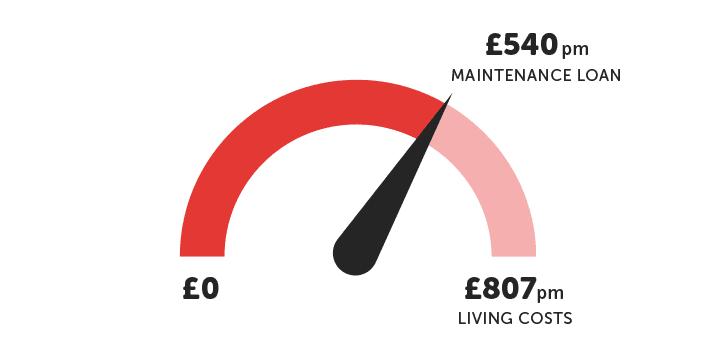

The Maintenance Loan was designed to give students cash to live on at university, so it’s a real clanger that most don’t get enough to meet their needs.

The £267 monthly shortfall is a combination of things. Firstly, living costs – especially rent – are higher than you might expect. Secondly, linking Maintenance Loan to how much parents earn, and expecting them to magic up the extra cash, is naive at best.

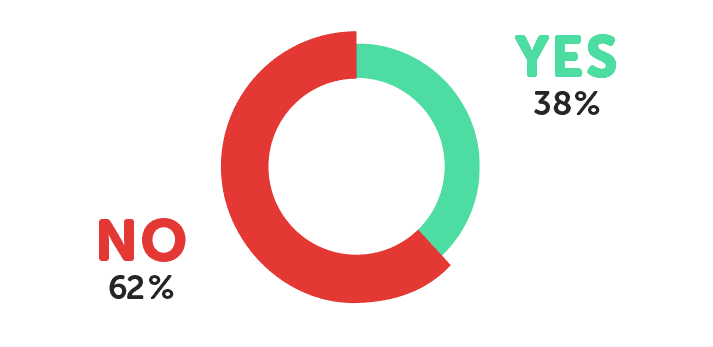

It's no surprise that 62% of students think the Maintenance Loan is not big enough.

What students say about surviving on Student Finance:

- After my rent went out I had roughly £5 to live off.

- My £4,054 a year doesn’t cover my £5,760 rent and bills cost, let alone food and supplies for university.

- Oxford is fairly expensive yet the Maintenance Loan is still lower than London (even though Oxford prices are very similar)

- It barely covers accommodation costs, making it necessary to also have a job alongside studies. My course also caps part-time work hours to 10 per week.

- Any student who says they can't live off their loan is lying in my opinion - it's all about knowing how to budget and save money!

How to survive on Student Finance

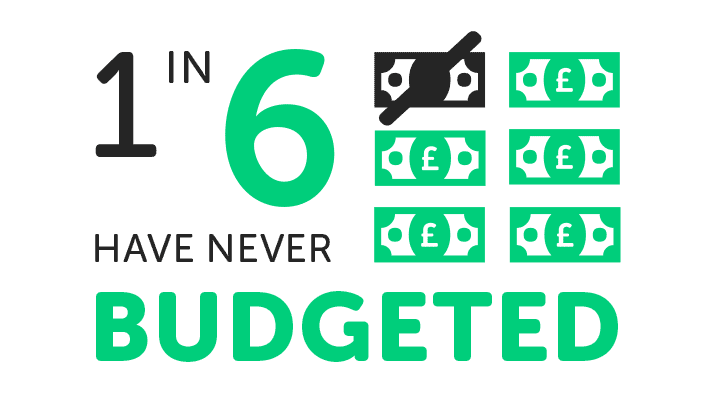

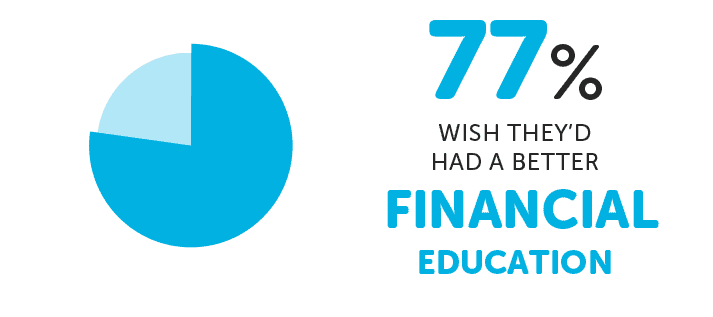

Short of waiting around for the government to get real about funding, solid money skills are essential if you want to survive uni. Yet we found that 1 in 6 students still don’t budget, while a mammoth 77% start uni without having been shown how to manage their cash.

If that’s you (or someone you know), it’s time to tool-up:

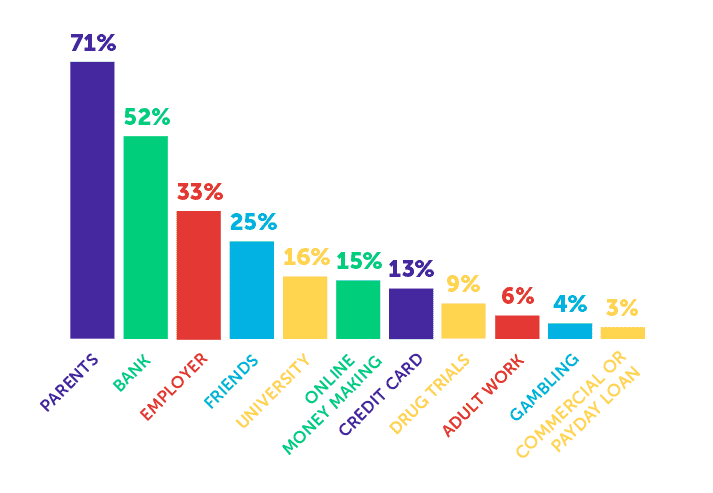

Where do students get money from?

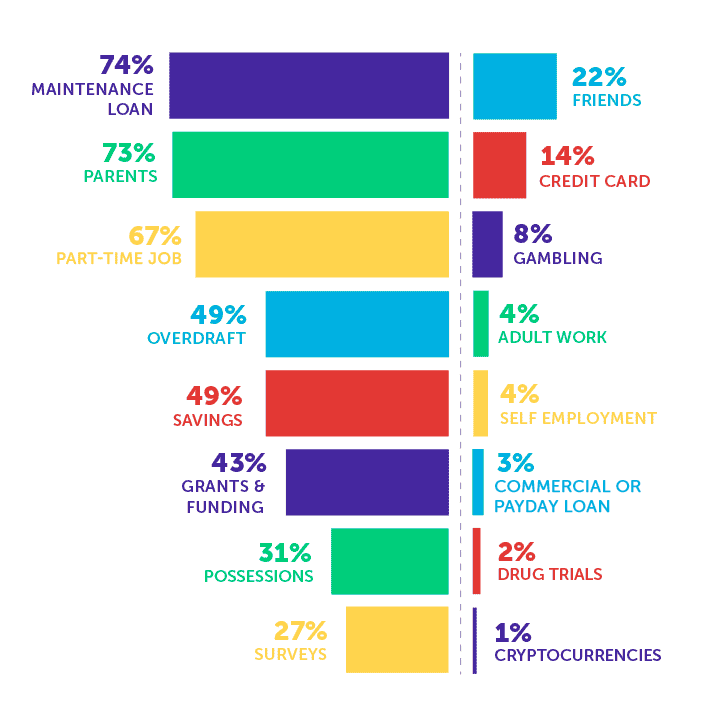

The Maintenance Loan and parents are the biggest sources of student funding - but this doesn’t mean students aren’t pulling their weight. Two-thirds juggle a part-time job alongside a degree (although half say their studies suffer as a result).

Worryingly, fewer undergrads rely on the Maintenance Loan, Mum & Dad, or part-time jobs than in 2018, with more students turning to credit cards, overdrafts and private loans. There are also noticeably more students using adult work or gambling to make money.

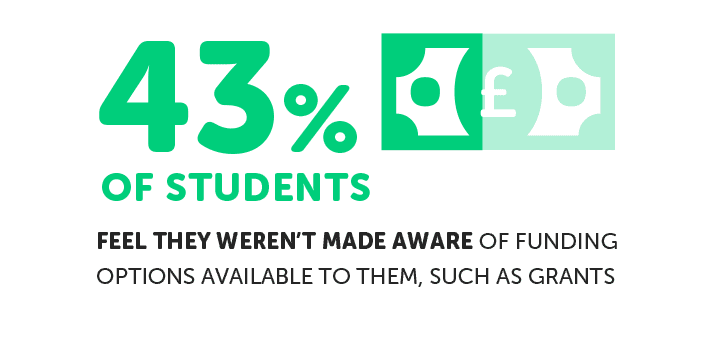

Most shocking of all is that 43% of students weren’t told about funding or grants they could be entitled to. Never assume you’re not eligible! Always check for yourself, then apply for anything that sounds remotely like a match. Get started in our funding guide.

Most shocking of all is that 43% of students weren’t told about funding or grants they could be entitled to. Never assume you’re not eligible! Always check for yourself, then apply for anything that sounds remotely like a match. Get started in our funding guide.

What students say about making ends meet:

- It is really difficult coming from a lower income family and having to make-do with less than students whose parents give them money to spend and pay their accommodation.

- My mum is single and self-employed so I receive over £7,500 a year in Maintenance Loan. It’s great as I’ve been able to save for a house for when I finish uni - I only pay £100 a month rent to my mum.

- I live off of gambling because I have no other choice.

- My overdraft makes me cry. I’m £700 in and I’m so worried about my parents finding out.

- Let’s just say I started uni with ten grand in savings and haven’t spent a penny on a holiday abroad, clothes, a night out or anything. Now I’m sitting here with a part-time job and only £500 in my savings. This degree best change my life!

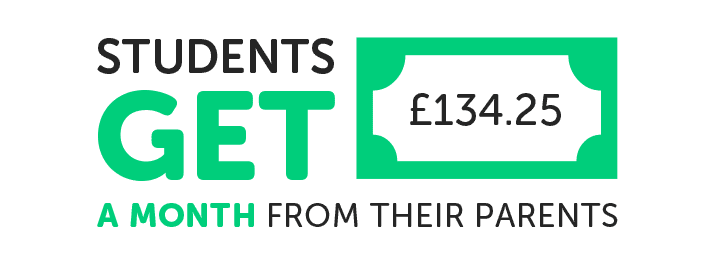

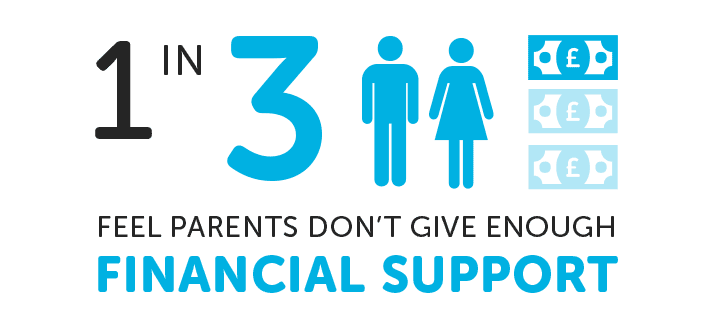

The parental contribution

Higher-earning parents are meant to bung a bit extra in the pot to help their kids at university. In reality, not everyone knows about – or can afford – the parental contribution, and that leaves some students permanently skint (or shame-faced for asking).

Higher-earning parents are meant to bung a bit extra in the pot to help their kids at university. In reality, not everyone knows about – or can afford – the parental contribution, and that leaves some students permanently skint (or shame-faced for asking).

The best strategy is to tackle this well in advance. Start by working out how much your parents are expected to chip in with our parental contribution calculator.

If your folks earn enough to contribute, talk about how much they can really afford (or are willing) to give you. If it’s not a lot, you’ll need a money maker of your own.

The bottom line is that, until official funding recognises the reality of student living costs and family expenses, students are likely to suffer. The best way to protect yourself is to be clear about the costs, embrace budgeting, and have a back-up plan.

The bottom line is that, until official funding recognises the reality of student living costs and family expenses, students are likely to suffer. The best way to protect yourself is to be clear about the costs, embrace budgeting, and have a back-up plan.

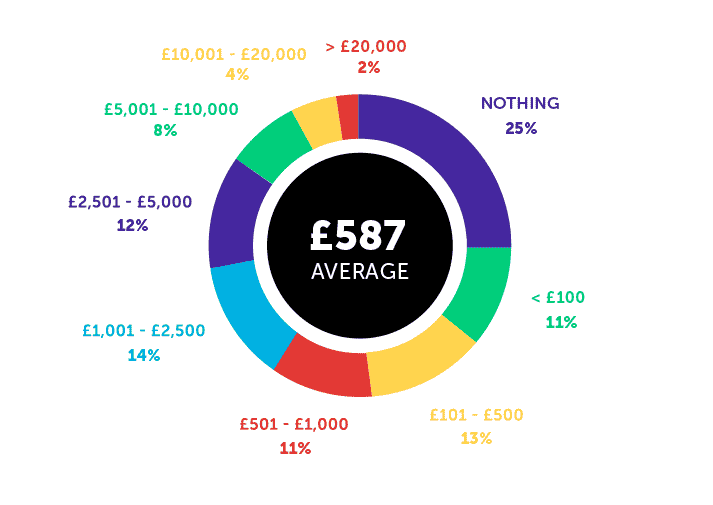

What about savings?

The good news is that 2 out of 3 students squirrel away cash before they get to university. But with 1 in 4 saying they have nothing in the bank, it sounds like many students are forced to dip into savings to get through their studies.

Don’t let that put you off! If anything, it shows how crucial back-up funds are. Make yours go a bit further by grabbing a student savings account that pays decent interest.

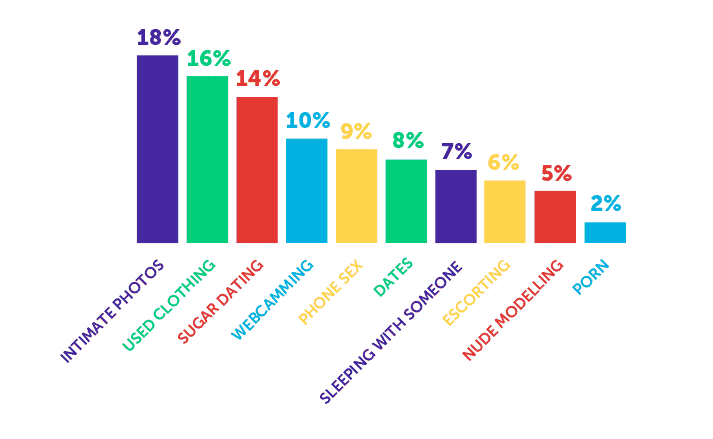

The truth about adult work at university

Around 4% of students have done some kind of adult work – that’s double the 2017 figure. And, while it sounds like a small percentage, it could represent as many as 70,000 people (based on the most recent HESA count of undergrads).

So, what is adult work? The simplest answer is any job or service which involves nudity or erotica. Not all adult work involves sex.

What kinds of adult work have students tried?

You’ve probably heard a lot about sugar dating in the press, but students are actually more likely to sell sexy photos or used clothing (i.e. underwear). This could be because it’s much easier to get started and stay anonymous: some students told us they do it via social media.

Where would students turn for cash in an emergency?

An additional 6% of students say they would try adult work if they needed emergency cash. In fact, this appears to be how many get started, especially when parents or funding falls short.

What students say about trying adult work at uni:

- I work for a sex chat line. I don't like it, but I need money and at least it doesn't require me to be touched by strangers.

- I sold my socks and me and my flat mate sold worn pants on eBay.

- I have signed up to fetish websites and talk to pay-pigs for money - have received up to £20 just for sending a few messages!

- Being an escort is tiring and you’re constantly living two lives and concerned about your safety. However, if I needed to I would do it again as it can be a quick and relatively easy way to make money.

- I've made money through having a sugar daddy - he would give me money for webcamming and chatting sexy online.

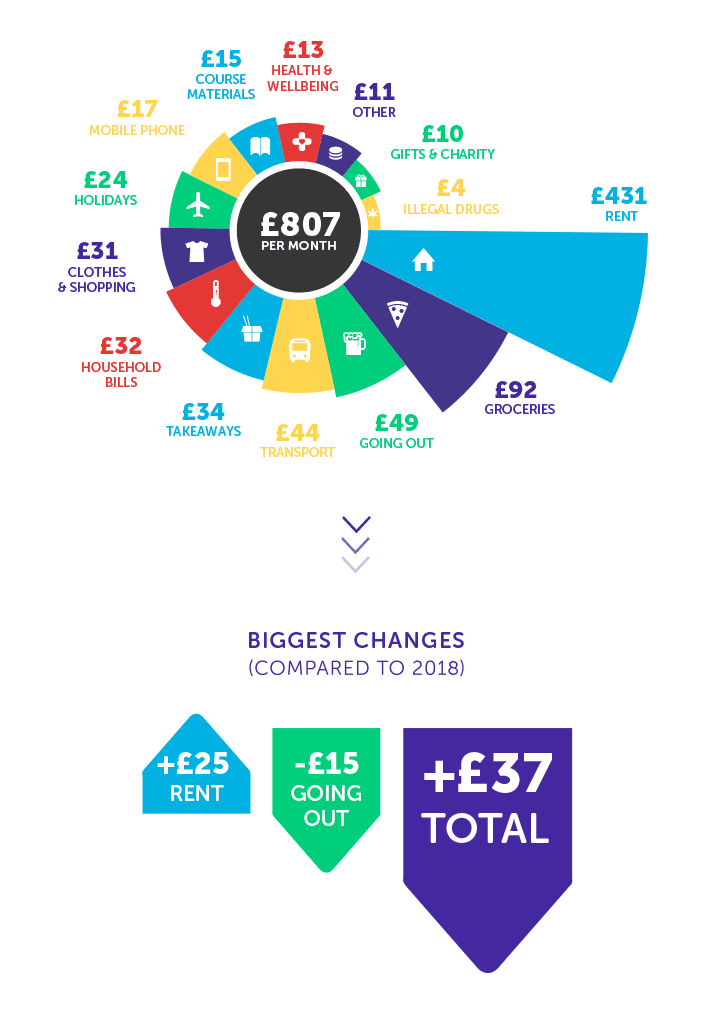

What do students spend their money on?

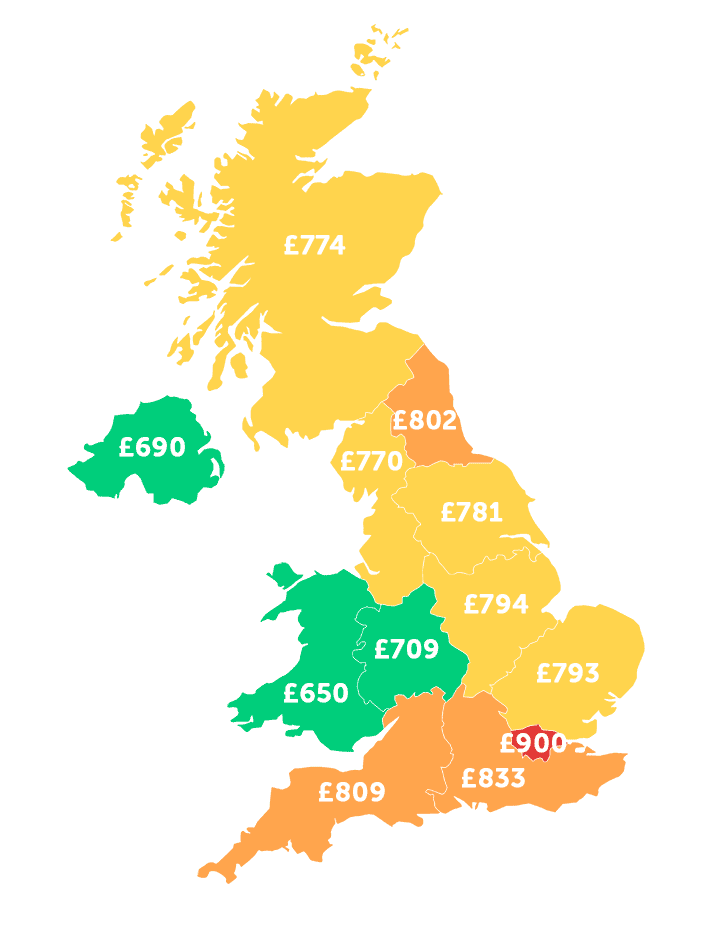

It’s getting more expensive to go to university – not because of tuition fees, but because living costs have gone up across the UK. Students now spend an average of £806.62 each month. That’s £37 more than in 2018.

Interestingly, international students spend slight more at £816 a month on average.

A large chunk of this is due to higher rents. This is a figure to watch closely, as some landlords may pump up prices following the ban on tenant fees. Either way, because housing costs take the biggest bite out of the student budget, paying less rent is a quick way to cut costs.

To help balance the budget, we can see students are increasingly cutting back on going out. This will have an impact on local nightlife economies in university towns.

Living costs around the UK

Cheapest universities in the UK

| University | Monthly cost |

|---|---|

| Ulster University | £573 |

| Bangor University | £574 |

| University of Central Lancashire | £593 |

| University of Derby | £619 |

| Cardiff University | £626 |

10 creative ways students have saved or made money

- My friend once sold fake nudes (knees in my lacy bra) to get money over Tinder

- Ordering clothes and shoes and bags online, using them once and then returning them

- I got an infection in my arm but refused to buy the antibiotics and tried using salt water - ended up in hospital and got given antibiotics, which were free at this point...

- I started embroidering designs into plain t-shirts instead of buying expensive clothing, it turns out people love my designs and I now sell them on Depop

- There’s a shortage of netball coaches in the south west, due to a lack of coaching courses in this area. I am a level 2 qualified coach. Within a month, I had three paid netball coaching jobs, including for a junior regional team

- I used to busk at the races which was a great money maker, even with just four songs

- I started my own Etsy business making earrings that I design and get laser cut at uni

- Selling fake nude pics: I used the crease in my arm from my elbow to look like a vagina and my sister (a make up artist) would help me dress it up with hair from kiwi skin

- Slept in a bus station instead of a hotel

- Eaten lambs livers I got for 14p in Tescos reduced section. Awful.

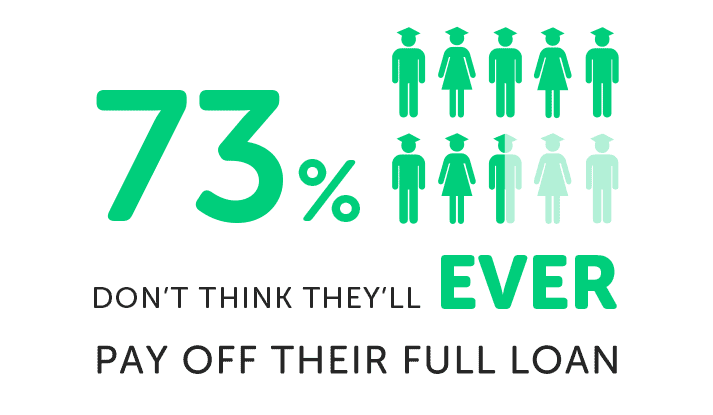

Do students understand their Student Loans?

So there’s ‘complicated’, and then there’s ‘Student Finance’. Save the Student lives, breathes and dreams this stuff, and even we find it a bit cuckoo. Unsurprisingly, some students feel they don’t stand a chance.

This is a big deal for a couple of reasons. Firstly, no one should ever sign-up for debt without understanding the terms (our guide to Student Finance keeps things simple).

More importantly, loads of students who are already stressed about money panic unnecessarily about paying back Student Finance. The thing is, you only repay when you earn enough. All things considered, the Student Loan is actually the tastiest dish at the buffet: here’s why.

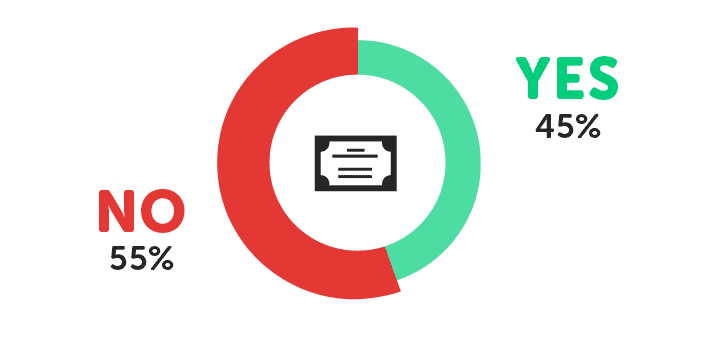

Is university good value for money?

Getting a degree or advanced qualification isn’t just about the money, but it’s no secret that high fees and lack of funding (or support) has left some students unhappy.

What’s worse is that getting help from the university – help you’ve technically paid for – isn’t up to scratch. Incredibly, among students who turn to their uni, just 38% find it easy to get financial support or advice.

What students say about paying for university:

- I went to the university for financial support and was denied as I hadn't completely maxed my £2,000 overdraft as I work a full-time job. Friends who have never worked to support themselves were handed money. It was the most distressing part of my university experience.

- University is more like a money-making business than an education system.

- EU students need as much or even more help with bills as UK students. Actually every student should be treated equal and have maintenance loans at least that covers rent!

- It would be nice to have lower tuition fees as I feel like I'm not getting £18k worth of education.

- I just can’t believe that on my course (fine art) you have to pay for all materials you want to use throughout your studies on top of the yearly fee of £9,250 - and I don’t qualify for a grant. Sometimes I question what I’m paying for as there’s not a great deal of lectures and meetings!

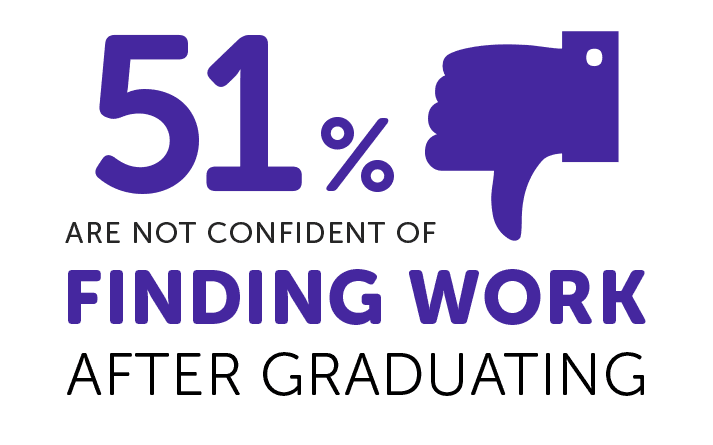

Life after university

Going to university is a gateway to a better life, thanks in part to extra career opportunities and higher graduate earnings. Unfortunately, students aren’t feeling too optimistic about either of these right now.

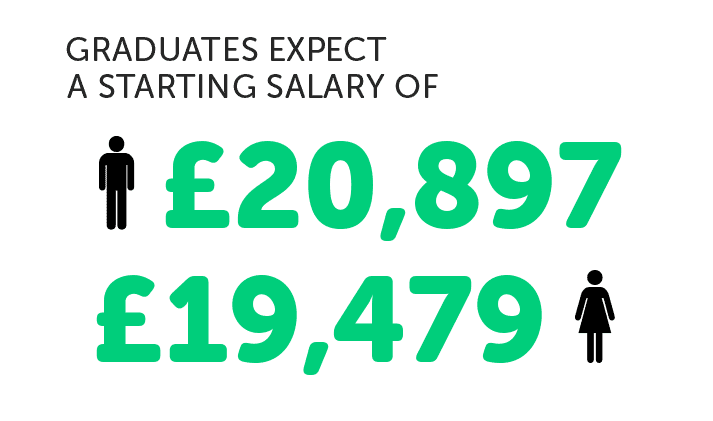

Students expect to earn just £19,707 in their first graduate job – that’s even less than in 2018.

You’ve probably heard a lot about the gender pay gap, but there’s evidence it starts pretty early in life. On average, women expect a lower starting salary than men do.

Our comments

Going to university can be a brilliant choice for your career, personal development, independence, world view and loads of other reasons. That said, too many students struggle unnecessarily because of hidden costs and a lack of funding - that's why we conduct this national survey every year.

Jake Butler, Save the Student's money expert, comments:

This year we’ve seen a shocking jump in the number of students suffering from the stresses of rising living costs, especially surrounding mental health, socialising and academic performance.

Our findings reveal that current maintenance loan allowances fall woefully short of reality. In too many cases students are forced to desperate measures in order to simply continue their studies.

Addressing the funding gap must be the highest priority for returning Universities Minister, Jo Johnson.

Meanwhile, it’s more important than ever for students to be aware of the financial pressures from the outset, so they can plan and budget effectively.

About this survey

Our findings are completely independent: we don't conduct this survey to sell products to students, or to keep universities and advertisers happy.

Since 2013 we have reached out to university students all over the UK for their honest opinions about the costs of university. We crunch the numbers to tell it like it is and improve the advice we provide across our website.

Want to know more about the survey, need case studies, comments or quotes? We’re happy to help – just drop us a line.

- Source: The National Student Money Survey 2019 / www.savethestudent.org

- Survey polled 3,385 university students in the UK between 24th April-30th May 2019.

- Average maintenance loan based on a student living away from home (outside London), with a household income of £35,000.

- Data from previous surveys.

- Save the Student Press Page.

- Tools and resources.

Student Money Cheatsheet

Download The Student Money Takeaway for free. This printable PDF distils the very best advice from our website onto just 2 pages, including a 1 minute budget sheet. It's designed to be accessible, fun and engaging.

We created this resource in response to the alarming findings from our recent student surveys, particularly with 57% reporting poor mental health due to money worries.