“I felt utterly helpless”: 46% of students say student finance affects mental health

We spoke to a final-year student about how poor student finance left her feeling isolated, stressed and suicidal at university.

In our latest National Student Money Survey, a huge 46% of you said that money troubles at university have affected your mental health, and 78% of students said they worried about making ends meet while they study.

While the numbers themselves are shocking, we spoke to one respondent to get a better idea of exactly how poor student finance can have an impact on student mental health.

Chloe (who asked us not to use her real name) has been forced to battle against the extortionate costs of buying extra course materials, along with an inadequate Maintenance Loan and the pressures of a part-time job throughout university, and her mental health has suffered as a result.

In fact, at times she's contemplated suicide as a way to escape from the stress of trying to survive on such a small income.

I've thought of suicide a few times at uni.

I looked up different ways to do it and decided that I probably had enough painkillers, but the only thing that ever stopped me was my family.

It felt impossible to survive on what little money the government provided.

Unfortunately Chloe is far from alone in experiencing such thoughts - in the last academic year, 95 students committed suicide while at university, and the number of students seeking support from university counselling services is on the rise.

While mental health problems can be caused by a huge range of factors, there's no denying that the strains of insufficient student finance are having a huge impact. Chloe explains how.

Insufficient Maintenance Loans

Credit: Manchesterphotos - Wikimedia

For Chloe, high rent costs and the failure of her Maintenance Loan to cover this left her with very little money to survive on. In fact, in her second year this equated to as little as £38 a week to cover food, bills, transport, course materials and other living expenses.

During my second year at uni I received £6,974 and my rent for the year was £5,148, leaving me with £1,826 to live off.

I was lucky enough to have a job by this point so the pitiful amount from the government didn't seem too bad at first.

While the government expects parents to plug the gap when Maintenance Loans fall short, Chloe says this wasn't an option for her - and isn't for many students.

I received no help from my parents as they weren't in a position to. For me, asking for help wasn't an option.

Unfortunately, my family back home were going through financial difficulties... It got to the point where they were at risk of losing the house if they didn't pay rent, so I had to help them out with what I had in savings.

Our survey found that parents are forking out an average of £138.50 a month to help students get by, and those who aren't able to turn to parents for extra cash are forced to find funds themselves.

Plus, Chloe says that she was forced to cough up for a range of costs at uni that severely drained her finances.

The uni expected us to buy a ridiculous amount of materials for my course that weren't cheap and I had to pay out for a dyslexia test, as the uni refused to give me academic help until I provided new evidence of my learning disability.

The effect on mental health

The combination of these stresses quickly started to have an impact on Chloe's mental health, as she struggled to make ends meet and her grades began to suffer.

I ended up taking more hours at work, doing something like 28 hours a week on top of being at uni four days, just so I could send money home and still try and afford to eat each week.

This meant my uni work suffered because I didn't have time to do any after classes, as I'd often go straight from uni to work.

I think it was at this point it felt like my life was just collapsing around me - I felt guilty for not wanting to work just to give my money away, I felt pressured to do well at uni and I felt like I was missing out on making strong friendships because I didn't have the time.

In our survey, many of you reported that your money troubles were having a negative effect on things like your studies and friendships.

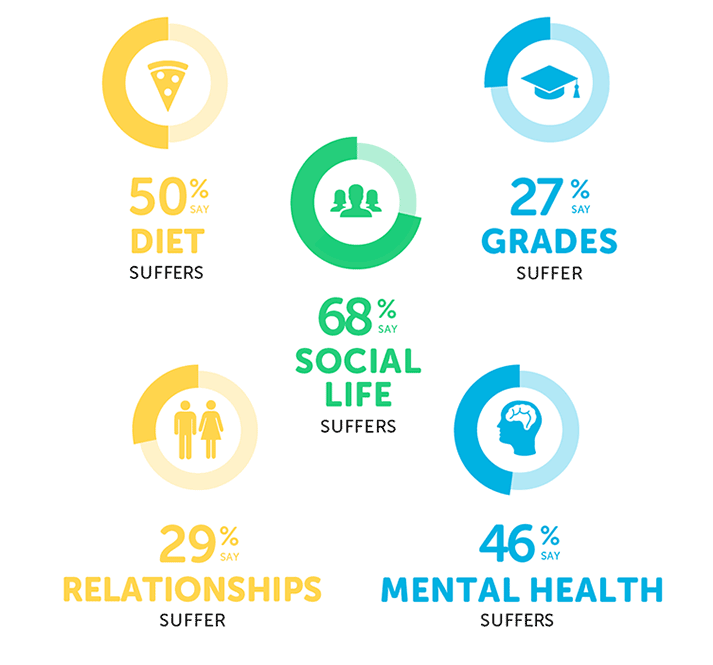

As a result of money stresses, 50% said their diet suffers, 68% said their social life suffers and 27% said their grades suffer. So what's being done about it?

The university mental health crisis

Credit: Policy Exchange - Flickr

Media coverage and government discussion of the student mental health crisis has increased sharply in recent months, and every other week a new stat makes the headlines.

A spate of student suicides, particularly at the University of Bristol where 10 students have died since October 2016 (a number of which have been confirmed as suicides), has prompted the government to take action. But what are their plans?

Government action plan

- A university mental health charter which will set out some basic criteria that all universities must meet in order to prove they are taking the necessary steps to support student mental health. Universities that comply will receive official recognition

- A Department of Education review into the transition from school to university, to make sure first year students are receiving the necessary support when they're most vulnerable

- An optional alert system which would ask students to give permission to their university to contact their family in an emergency or mental health crisis. The system would be completely voluntary, and students could opt out at any time.

Notice something that's missing? The government have yet to acknowledge that student finance is a major contributing factor in the growing mental health crisis at universities.

94% of universities have reported a sharp increase in the number of students trying to access their mental health support services in the past five years. It's no coincidence that those same five years have seen tuition fees rise to £9,250 a year, Maintenance Grants and NHS bursaries scrapped, and rent costs spiral.

If your mental health is suffering and you need someone to talk to, call the Samaritans on 116 123 or email [email protected].

Do you think the government needs to improve student finance in the UK? Let us know in the comments!