Student Money Survey 2018 – Results

UPDATE: View our 2023 National Student Money Survey.

Going to university has never been more expensive - but what do you get for your money? Time for the National Student Money Survey 2018 to sniff out the true cost of getting a degree.

If you want to know how much a degree actually costs, ask a student. Even better, ask 3,167 of them for a warts-and-all insight into what life at uni is really like.

That’s how many students at universities all over the UK answered our National Student Money Survey 2018 – and you guys didn’t hold back: thank you!

We’ve crunched the numbers and Tippexed a few typos, but everything on this page is as told by students. So, whether you’re pricing up uni accommodation, need emergency cash, or are curious how your costs compare, this page will give it to you straight.

What's on this page?

What's it like living on a student budget?

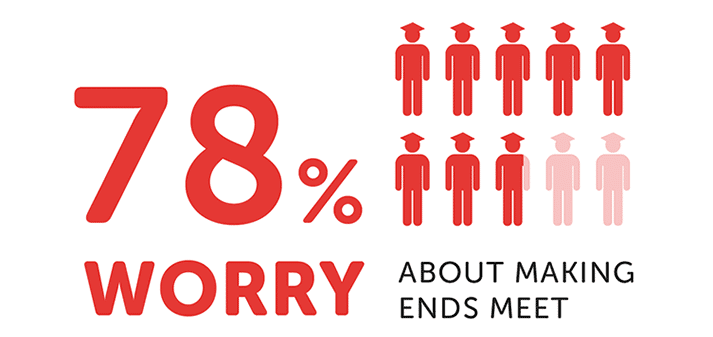

Getting by on a student budget is pretty damn hard. Not only are 78% of students stressed about money, some of you can’t afford to eat or drink, let alone do anything else.

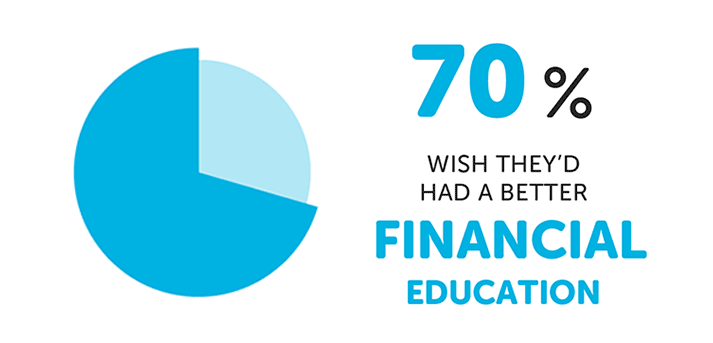

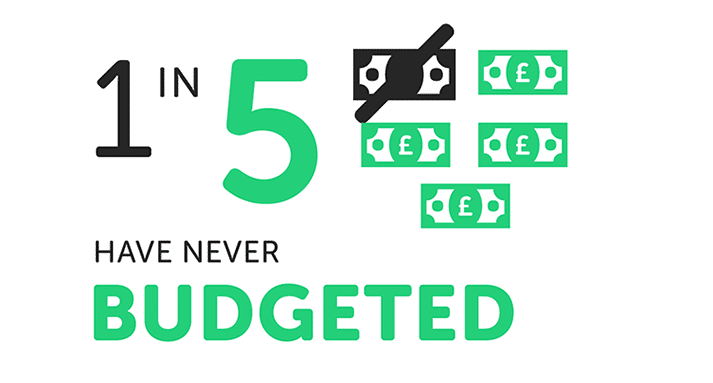

The truth is that many students arrive at uni lacking basic money skills, or clueless about what costs are really involved. Whether that’s because schools, government or parents aren’t teaching the basics, it leaves students on the back foot when they first hit campus.

Here's just some of what you had to say regarding living on a student budget:

- I think that university life really depends on the income of your parents – and it shouldn't be that way.

- After my rent, I’m left with an average of £2.09 to live on each week. That’s to cover food, clothes, transport and books.

- I’ve managed to pay all of my bills, travel to different countries for a total of 10 weeks, and will have savings of around £2,000/£3,000 by the time I graduate. The Loan is more than enough if you know how to handle money.

- I cannot afford to live anywhere near my uni … I spend over £100 a month in travel costs.

- I have 30+ contact hours a week plus lots of personal revision. I don’t have time to work during term so can only afford to spend £60 a month on all food and drink (inc. groceries or drinks at the pub).

The skint effect

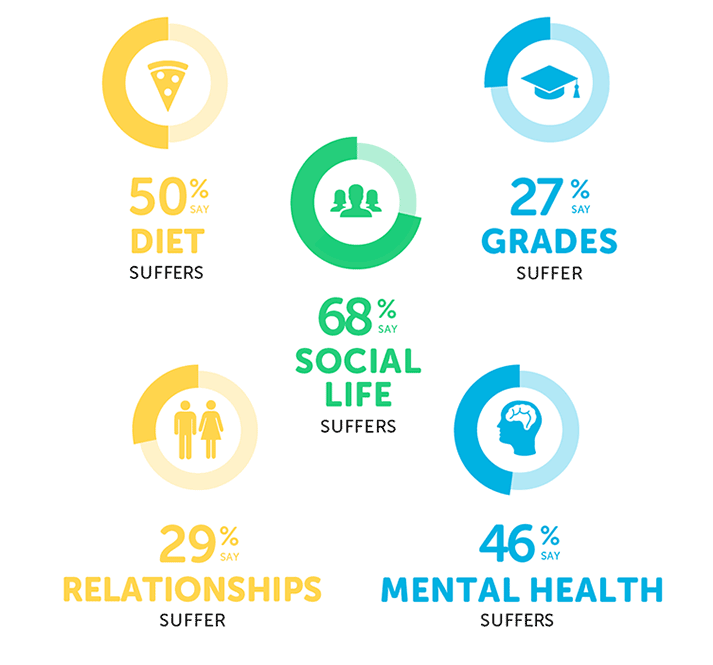

When it comes to living on a budget, something’s gotta give: for students, that’s their social life. Two-thirds of you say you can’t afford to go out – bad news when it comes to being happy.

I’ve missed out on ski trips and placements, as well as nights out. The more you are enjoying yourself, the more energy you put into your degree, so having a lack of money has meant I feel as though my grades have suffered.

Lack of cash also means half of all students can’t eat as much, as often or as healthily as they’d like. It also affects relationships and grades, and can be particularly tough on your mental health.

The stats make for startling reading, so just how do you cope when you’re low on funds?

- Eaten food in a bin.

- Stolen food from Waitrose or my housemates (not that I wanted to). I’ve used a food bank.

- Not gone onto campus as food there is too expensive.

- Not used the heating all winter and instead opting to wrap up in four layers to go to bed.

- Stolen toilet roll from university.

- Volunteered at charity events where I would get a free meal, so that saved on dinner expenses a few nights a month.

- Being poor has pushed me to look into sex and cam work.

- You end up worrying not just about yourself but also about friends, especially when they get depressed about money and it happens regularly.

With staying debt-free being a tall order at uni, a money plan is crucial. Luckily, most students have one – although a 18% still don’t budget.

Does student finance stretch far enough?

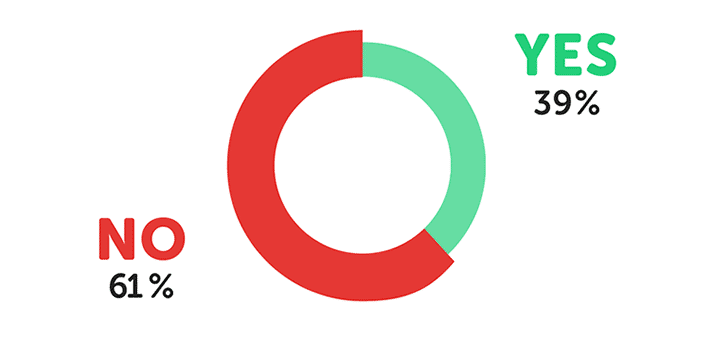

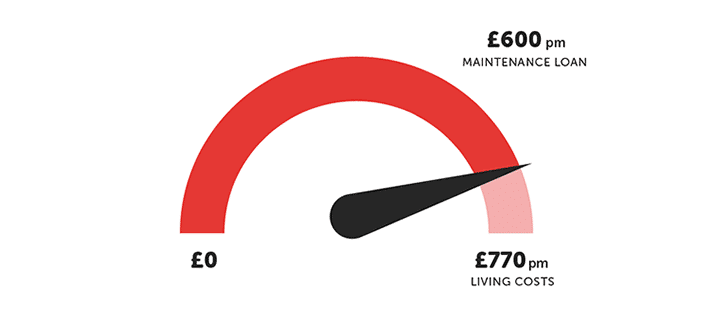

61% of students who get a Maintenance Loan say it’s not enough to live on. Many add that maintenance cash doesn’t even cover rent, leaving them extremely hard-up for the rest of the year. You definitely need to know what student grants are out there!

Update 01/02/2019: The average maintenance loan used in this report was based on a student from a household income of £35,000 studying outside of London. Since this report we have obtained official data from the student loans company which shows that in fact the average maintenance loan is closer to £540.

Perhaps quite worryingly this means that the gap between the cost of living and the money students get from the government is in fact £230!

There’s no love lost for Student Finance. Frankly, most of you feel hard done by because your parents either don’t earn enough to help you, or earn just a little too much for full maintenance support.

I feel 100% dependent on my parents and the government loan system is to blame. Myself and students with similar parental income are treated as dependent children by the loans system and will be until we graduate – I will be 25, hardly a child!!

Here's what some of you had to say about the Student Finance system:

- It’s way too little – after paying rent and bills it is well below the living wage.

- More students just need to learn how to be sensible with money. I have still have my student finance from semester one and I ate well, just sacrificed my social life a little because eating is more important than socialising, as is having money on the side for a rainy day.

- If I didn’t have support from my parents there is no way I could afford to pay rent and sustain myself at university.

- My loan per semester covers only 2 months of my rent and that’s without paying for food and other essentials.

- People with less wealthy families should receive a larger loan so that it can cover both maintenance and being able to live happily without using an overdraft.

- Last year I lived in the cheapest off-campus accommodation and still couldn’t afford to do a weekly food shop and pay my bills. Had to get two jobs because parents couldn’t help out at the time and my grades definitely suffered.

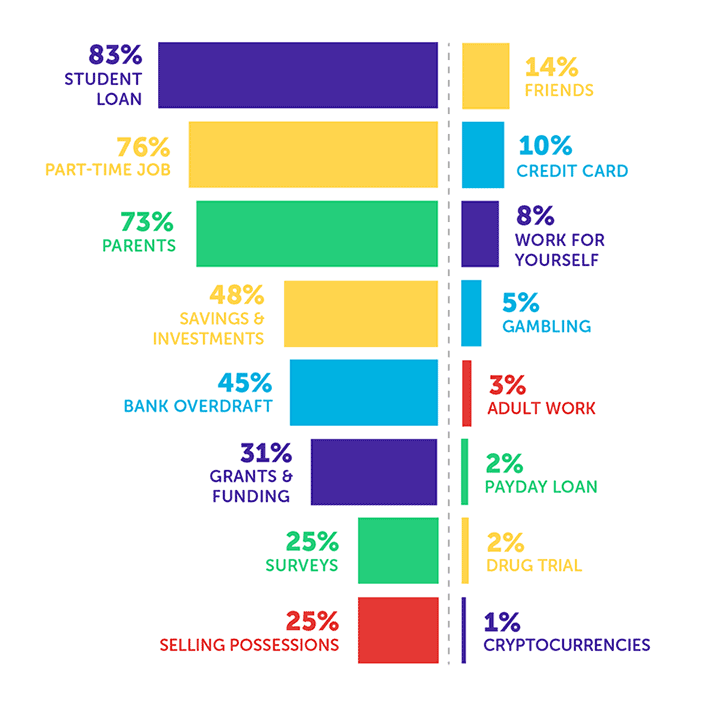

Where do students get their money?

If this year’s survey comes with a truth bomb, it’s that surviving uni probably means getting a job at the same time. The biggest sources of regular income for students are now the Maintenance Loan and part-time work, with almost as many students relying on both.

This is a pretty big change from the last few years, when parents – rather than jobs – plugged the gaps in Student Finance.

We're always advised to not have a job and focus on uni work, but this isn't financially viable, so it's pretty contradictory.

The kicker is that three quarters of students who get the Big Three (Maintenance Loan, family cash and wages) still worry about money. This could be because most students don’t get predictable monthly income – or it could be that living costs at uni just aren’t affordable.

The parent trap

Tackling parental contribution – how much the government thinks your folks should chip in – is like jabbing an angry bear with a toothpick. Unfortunately, that means some of you don’t know how much your families should give, while others say their parents can’t cough up.

We also heard a lot that you don’t like being dependant on your parents, feel guilty about adding to their costs, and resent your Maintenance Loan being tied to their earnings.

Parents hand over an average of £138.50/month for each child they support at university – that’s £1,662 each academic year. However, we also found that male students get around £60/month more than that, while female students get slightly less.

The biggest shock is that parents who earn under £25,000 (so, in theory, don’t have to contribute anything to top-up the Maintenance Loan) still give cash support. In fact, for students living away from home and studying in London, they’re paying £151/month MORE than they’re supposed to.

Higher earning parents, meanwhile, often don't meet suggested amounts - from what you tell us, that’s because the government overlooks the reality of household costs.

With a quarter of you saying your family is putting more than one student through uni, the pressure is on parents. And, with 1 in 3 students reporting the extra cash isn’t enough anyway, everyone’s losing out.

Here's just a snapshot of the comments you had on parental contributions:

- My parents’ income doesn't define their generosity.

- I am lucky that if I do have money troubles my mum wants to and can help me.

- My mother cannot afford to support me at university, bless her, but as she lives with her boyfriend I get the minimum student finance, meaning I work virtually full time alongside my studies.

- My parents have less money than I do.

- Some people get a lot of help from parents with costs and don’t worry about it but I’ve got to be really conscious and make my money last.

- I get the highest student loan, but if that runs out no one else can support me.

- My family is having to sacrifice day-to-day expenses (not luxuries) to support me at university.

- There is very little consideration given to other children that my parents have to support, one of which requires significantly more money for educational help due to learning issues.

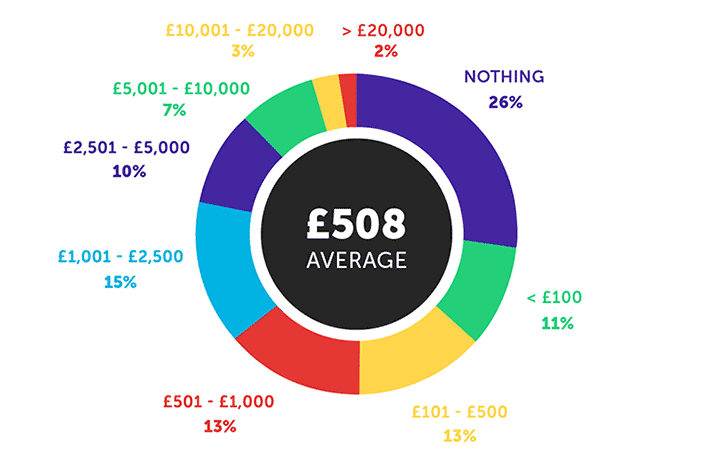

What about savings?

Fears about debt and loan interest rates may be turning students off borrowed cash: you guys are now more likely to dip into your savings than an overdraft to pay your way.

The good news is that 2 out of 3 students land at university with savings to hand. It’s harder to hold onto the cash once you’ve paid out for rent, deposits and budget noodles, however: a quarter of you have nothing to fall back on right now.

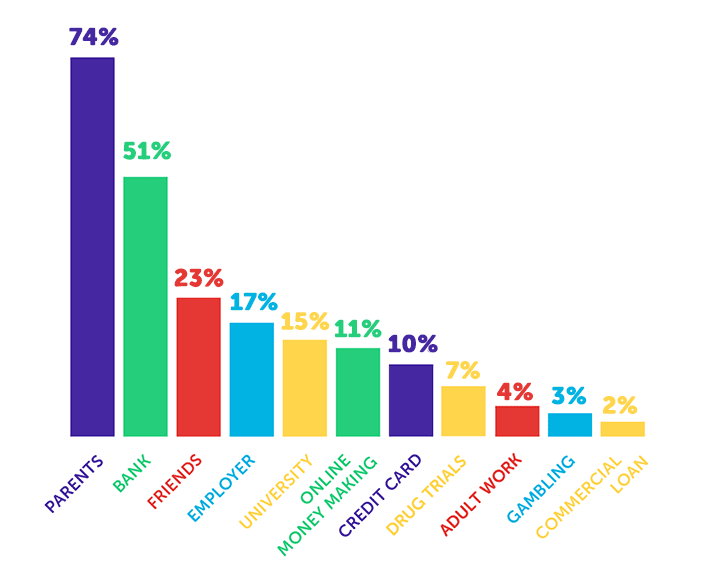

Where do students turn in a cash crisis?

With cash scarcer than fruit pickers after Brexit, unexpected costs at uni can mean big trouble. So, where do you turn when the chips are down? In a word: parents. As many as 74% of students turn to their folks for help in a financial crisis, followed by their bank.

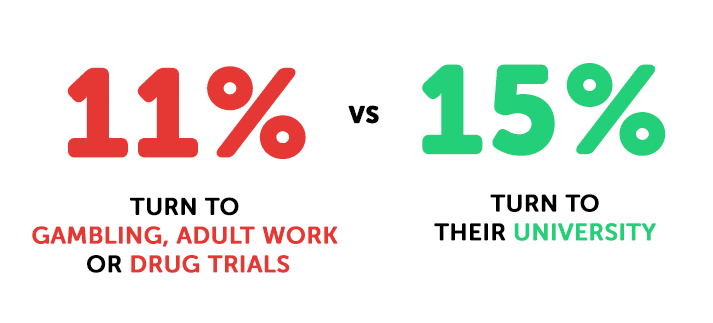

Testament to how patchy student support is, more of you ask your friends for help than your university. In fact, almost as many students use betting or their bodies (drug trials and sex work) as get uni hand-outs.

So just how far have you gone to make money?

- Buying a course book on eBay and selling back to the uni shop for a profit.

- Did an EEG study where I had sensors stuck to my head with gel for a month.

- I poo pick a horses field … the pay is good!

- One of my favourite things to do is check the floor for lost change. I once made £15 on a night out by checking the floor time to time.

- Licked a poo for £20

- Selling homemade jam for an insane amount of money. People still bought it.

- Selling worn pants.

What do students spend their money on?

Time for the big one: what cuts through the cash?

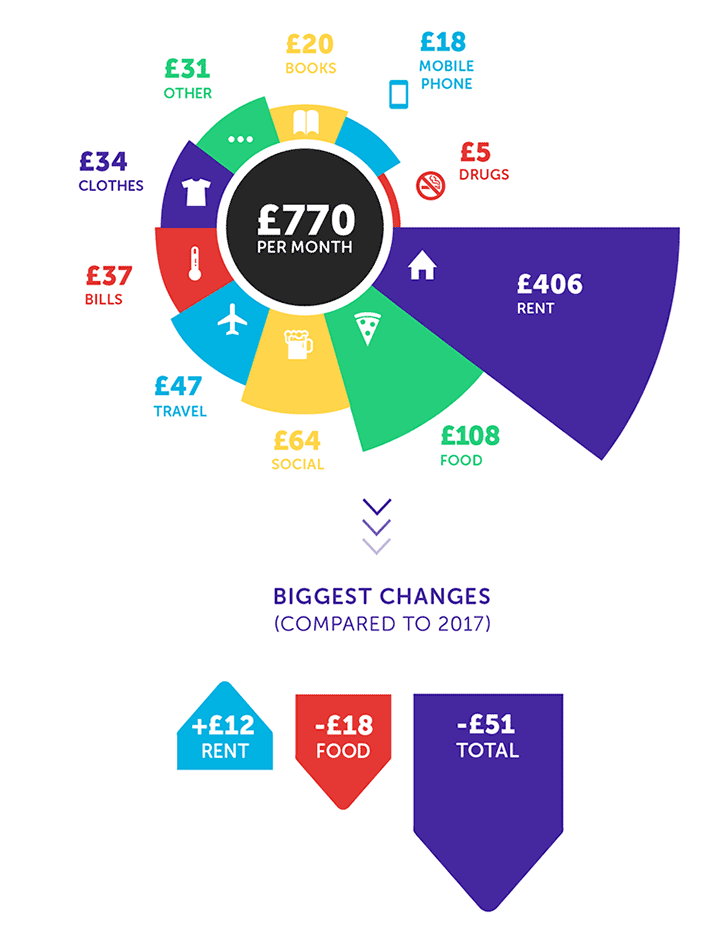

Rent takes the biggest chunk of monthly spending: students now pay an average of £406/month for housing, which is slightly up on a year ago. The big shocker is that most students now spend around £51 LESS each month than in 2017, leaving you £612 better off over the year.

The good news is that some of the savings come from spending less on household bills, possibly because it’s easier to shop around for better deals. What isn’t great is that it’s also because you guys are spending less on food and books - the very things you say suffer when you’re low on cash.

See what do students spend money on.

All this means that money needs to be saved, and you've certainly gone to some lengths to achieve that:

- I've walked through Manchester with a shopping trolley at rush hour to save money on a taxi home with my food shopping.

- I managed to sneak a whole bottle of white wine into a club wearing a dress, and the other time leggings and a T-shirt. Flasks are for novices.

- Lied about being ill so wouldn't have to socialise and spend money.

- Use my housemate's friend's mum's Netflix rather than pay for my own.

- Brought my own beer to the pub.

- I once froze my debit card in a block of ice in the freezer... turns out I forgot about my contactless Apple Pay.

- Sent back clothes I had already worn.

- Taken someone else's Tesco Clubcard discount to save money on shopping.

- Washed clothes in the bath to save using the coin-operated washing machines.

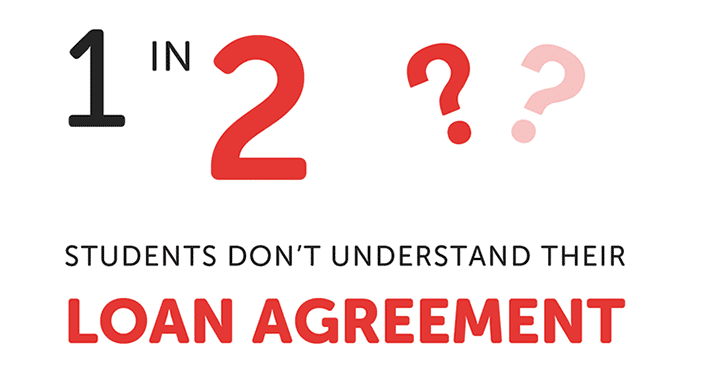

Do you understand your Student Loan?

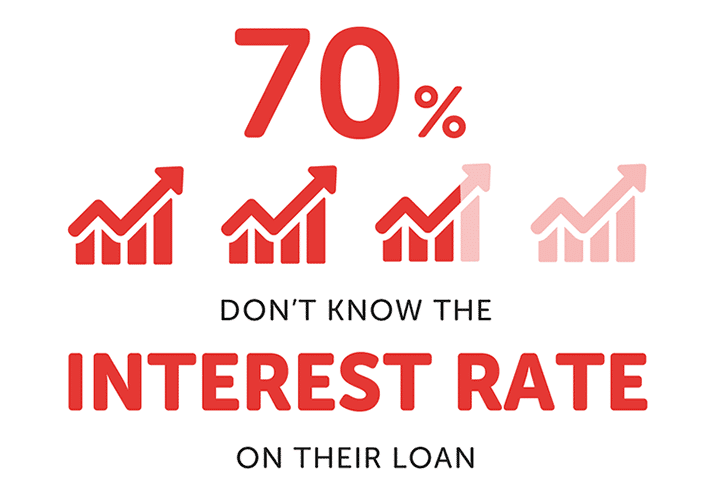

Anyone taking out a Student Loan has to get their head around some pretty tricky T&Cs – but we’ve found just 60% of you know what you’ve signed up for. It’s hard to stay on the ball, too, with 70% confessing they don’t know the current rate of interest for their loan.

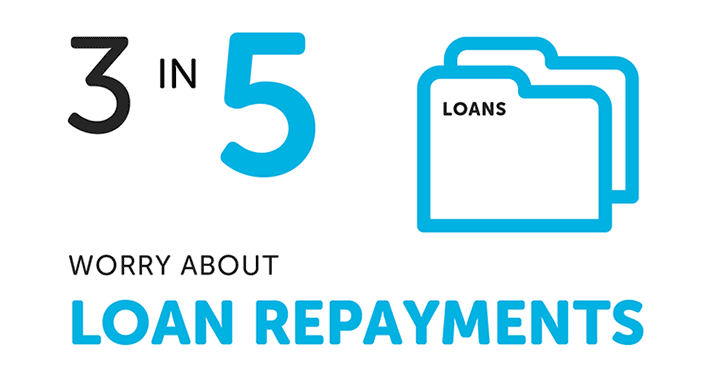

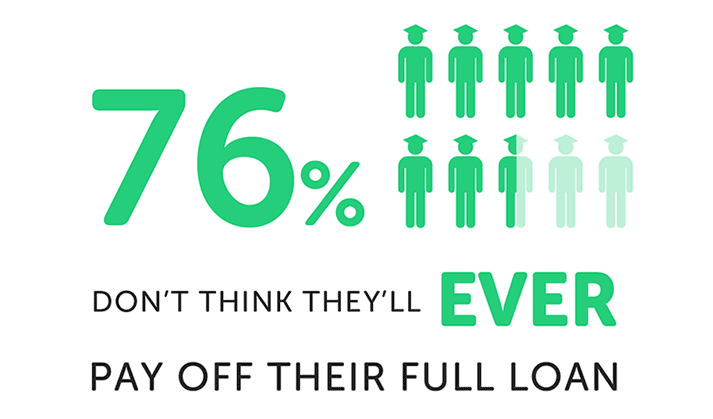

Not understanding how the loan works means a fair bit of stress: half of all students worry about the loan’s biggest safety net – repayments. Future tax payers should note too that only 1 in 5 students think they’ll pay back their whole loan (although some of you don’t know it could get wiped off!).

Is university good value for money?

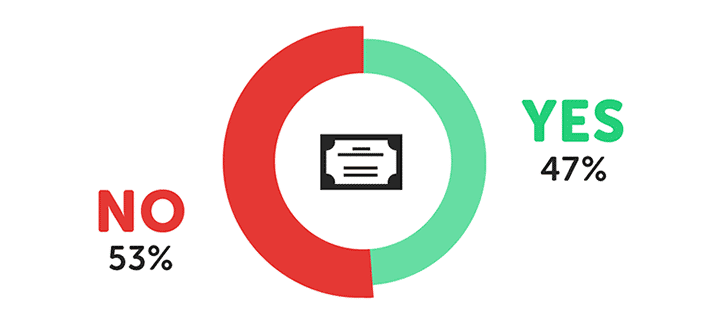

More students now think their course is good value for money! Before you break out the bubbly, we should add that just 47% of students feel satisfied. That’s a small increase from 2017, and still leaves a significant number who have something to complain about.

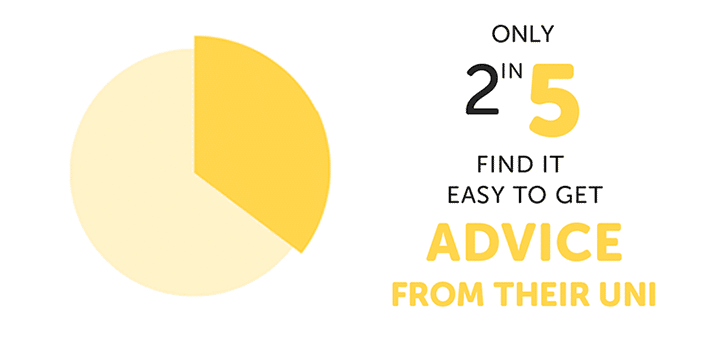

Unfortunately, getting a resolution isn’t plain sailing. Just 41% of students said they found it easy to get help from their uni when they needed it.

Thinking about life after uni

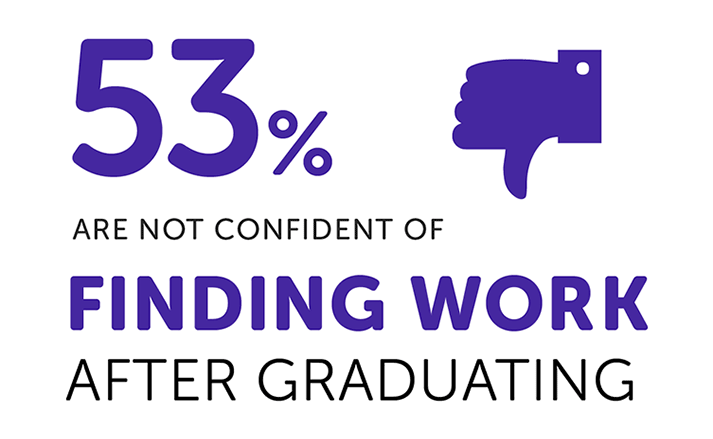

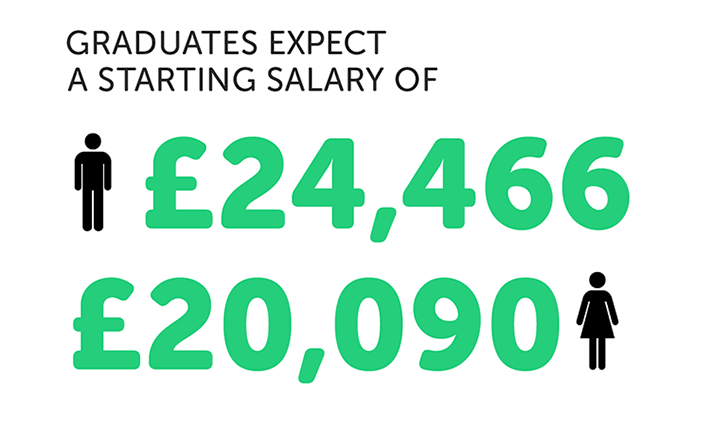

The high cost (and hardship) of university should be worth it once you’ve graduated – yet only 47% are confident about finding full-time work after their course. Students also predict a starting salary of just £21,283. At almost £2,000 less than the average graduate salary in the UK, that suggests you’re not exactly brimming with optimism about your degree.

In fact, while men feel slightly more positive about earnings than a year ago (when they predicted starting on £23,139), women still price themselves a full grand under the average, and four grand less than male graduates.

There will always be jobs that command more (or less) than others - but pricing yourself too cheaply, or accepting less than the going rate, can have a knock-on effect across the life of your career. Aim to know the starting salary for your job - then know how to level up if you need to!

Our take on it

Jake Butler, Save the Student money expert:

When it comes to student loans, the focus always seems to be on the £9,250 tuition fees or the extortionate interest. But the real issue is the insultingly low maintenance loans alongside the government’s unwillingness to admit that parents are expected to make up the shortfall.

It’s a huge talking point between students. Are they fully-fledged adults who are expected to fund themselves? Should they be asking their parents for money? Should their parents be forced to help them out?

The government needs to put an end to this confusion by being more explicit about parental contributions and/or increase the maintenance loan amount so that it is actually in line with real living costs.

The National Student Money Survey 2018 is done and dusted for this year, but if anything’s got your goat, got you worried or getting on your wick, leave us a comment below!

We’ve suggested lots of places to get more info or practical help in the report. If you want the basics to cut-out and keep, download our free Student Money Cheat Sheet.

Want to know more about the survey, or need case studies, comments or quotes? We’re happy to help – just drop us a line.

- Source: The National Student Money Survey 2018 / www.savethestudent.org

- Survey polled 3,167 university students in the UK between 16th May-18th June 2018.

- Data from previous surveys is available here.