Student Loan repayment guide 2024

Your Student Loan is probably the biggest amount of money you've borrowed in your life so far. But do you fully understand the Student Loan repayment terms? We're here to clue you up.

Credit: Marina Sun (formulas), Syda Productions (background, man) – Shutterstock

If you're like 42% of students in our latest National Student Money Survey, your loan agreement is a bit like your appendix: you know you've got one, but you're not entirely sure how it works. And that's not a good thing!

With tuition fees over £9,000 and interest being added all the time, your Student Loan debt is bigger than ever. As such, it's easy to ignore the details when it comes to repaying it all. But, the reality is that Student Loans aren't as complicated (or as scary) as you might think.

We've scoured the small print and broken it down into manageable chunks, meaning you can get to grips with Student Loan repayments and then get on with your life.

What's in this guide?

- Which plan is your Student Loan?

- Is student debt like other debt?

- How does Student Loan interest work?

- Plan 1 Student Loans explained

- Plan 2 Student Loans explained

- Plan 4 Student Loans explained

- Plan 5 Student Loans explained

- What happens to your student debt if you move abroad?

- Should you repay your Student Loan early?

- 5 things to do BEFORE paying off your loan

- Check if you have overpaid your Student Loan

Is your Student Loan Plan 1, 2, 4 or 5?

Which type of Student Loan you have depends on when you went to uni and which country gave you the loan (usually wherever you were living before you started studying – contact Student Finance if you're not sure).

We'll be referring to the different loans a lot. Before we dive into the details, here's how to find out whether you have a Plan 1, Plan 2, Plan 4 or Plan 5 loan.

Student Loan plans

| You got your loan from... | You started uni between 1st September 1998 and 30th August 2012 | You started uni between 1st September 2012 and 31st July 2023 | You started uni on or after 1st August 2023 |

|---|---|---|---|

| England | Plan 1 | Plan 2 | Plan 5 |

| Northern Ireland | Plan 1 | Plan 1 | Plan 1 |

| Scotland | Plan 4 | Plan 4 | Plan 4 |

| Wales | Plan 1 | Plan 2 | Plan 2 |

Wondering why there's a Plan 1, Plan 2, Plan 4 and Plan 5, but no Plan 3? There's a very good explanation for that.

Although it's not usually labelled as such, the repayment plan for Postgraduate Loans in England and Wales is actually Plan 3.

We've got more information in our guides to Postgraduate Loans in England and Wales. But, in essence, they operate in a very similar way to Plan 2 repayments. It's just that you repay a smaller percentage of your earnings over a lower threshold.

Is student debt like other debt?

The news always seems to be full of stories about huge student debt and astronomical interest rates. But, what no one tells you is that Student Loan isn't like other kinds of debt.

If you took out a Tuition Fee Loan (for course fees) and/or a Maintenance Loan (for living costs), the total amount you borrowed is your Student Loan (remember that grants, bursaries and scholarships don't have to be repaid).

However, Student Finance repayments don't start until the April after you've left your course AND when you're earning above a certain amount. Even then, you'll only repay 9% of your earnings over the threshold. See the Plan 1, Plan 2, Plan 4 and Plan 5 loan summaries to find out what your threshold is.

While there are no fees attached to taking out a Student Loan, interest is constantly being added, and the more you earn, the higher your monthly repayments will be.

Your Student Loan also doesn't affect your credit score – the infamous number that decides how generous lenders will be to you (like when you apply for a credit card or a mortgage).

One of the biggest differences between regular debt and student debt is that Student Loan repayments are automatically deducted from your salary before you get paid (meaning you can't miss a payment, even if you move abroad).

Another major difference is that the total debt is cancelled after 25, 30 or 40 years (depending on what plan your loan is).

As the debt is eventually cancelled (and you're unlikely to repay it in full before then), unlike most other types of debt, it may not be the best idea to make extra repayments in an attempt to clear your Student Loan early.

Save the Student's COO, Jake Butler, said:

There have been a few appeals to the government to label Student Loans and the debt as something more like a graduate tax.

The truth is that the majority of students under the current system will simply pay 9% of anything they earn over a threshold for 30 years after they graduate, regardless of the size of their debt or the interest being added to it.

This sounds more like a tax than a debt, right?

Well, the Augar Review into university fees and funding suggested that Student Loans be renamed as a 'student contribution system'. Although it doesn't seem like the government is planning to implement this proposal, it's encouraging to see that those in power may be starting to listen!

How is Student Loan interest calculated?

Credit: eamesBot – Shutterstock

Over the past few years, you might have seen a lot of news about the government increasing the interest rate on Plan 2 Student Loans. While this is technically true, and we're against the principle of students being burdened with extra debt, there is a very important point to stress: the added debt is essentially meaningless.

As the debt is already so big, and the repayments are so small, many graduates won't repay them in full.

However, students from England who started university in September 2023 will be on Plan 5, which will likely lead to a higher proportion repaying their loans in full.

The government has predicted that among full-time undergraduates from England who started uni in 2022/23, around 27% will repay their loans in full. However, for those starting in 2023/24, this increases to 61% who are expected to repay their loans in full.

Now down to the details. Interest starts accumulating from the day you take out your loan (so yes, even while you're studying) and carries on building until the day you clear your balance.

If you repay in full, you'll have paid back more than you borrowed. But that's just how interest works, unfortunately. That said, there's slightly more to it than that because of a little thing called RPI.

RPI (the 'Retail Price Index') shows how much prices have risen (or dropped) across the UK in the past 12 months. Student Loan interest rates are based on RPI and, as RPI can go up or down, interest rates can too.

Of course, as the interest only affects the total value of the debt, and not how much you repay each month, higher interest rates only make a difference to the highest-earning graduates (the ones who are likely to repay, or get close to repaying, their entire Student Loan).

The role of RPI in your Student Loan interest will depend on the type of loan you're on. Check out the interest rates for Plan 1, Plan 2, Plan 4 and Plan 5.

Plan 1 Student Loans explained

Did you take out your loan in England and Wales between September 1998 and August 2012, or anytime since September 1998 in Northern Ireland?

If so, you were probably lucky enough to have lower tuition fees, plus student grants and other free cash. You'll have probably borrowed much less than those with Plan 2 loans, and you'll have gained less interest on it, too.

Plan 1 does have one downside though. Your monthly repayments will be more than those who had to take out a Plan 2 loan (we'll explain why shortly).

What is the interest rate on Plan 1 Student Loans?

The interest rate for Plan 1 loans is usually set each September (keep reading, because it's not as cut and dry as that) and is always at whichever is lowest between:

- The RPI rate from March of the same year

- The Bank of England base rate plus 1%.

Unlike Plan 2 loans, the interest rate on Plan 1 loans is always the same whether you're studying or have graduated, and isn't affected by how much you're earning either.

As of September 2023, the Bank of England base rate is what we're interested in (5.25%), so the base rate plus 1% is 6.25%. This is lower than the RPI figure from March 2023 which was 13.5%. Therefore, the interest rate on Plan 1 Student Loans is 6.25%.

Of course, as you may have seen on the news, the Bank of England's base rate can change throughout the year. If and when this happens, the interest rate on Plan 1 Student Loans can change before its usual September review.

The cost of living crisis has underlined this fact.

In an 'ordinary' year, the Plan 1 interest rate should have remained the same between 1st September 2021 – 31st August 2022. However, as rising inflation pushed the Bank of England to increase its base rate time and time again, the Plan 1 rate also went up in October, December, January, March, April and June.

You can see interest rates for previous years on the Student Loans Company website.

How much are Plan 1 Student Loan repayments?

You'll only start making Student Finance repayments once you've left your course and are earning enough.

The repayment threshold for Plan 1 loans is currently £22,015/year (£1,834/month or £423/week) before tax.

This threshold has risen in April of each year since 2012, so make sure you keep up to date with the figure. And remember: if you earn less than that in taxable income (wages, freelancing, tips etc.), you won't pay anything back until you're back above the threshold.

Once you earn more than the threshold, repayments kick in and you pay 9% on the amount above the threshold. So, if you earn £27,015 (£5,000 above the threshold), you'll pay 9% of £5,000, which is £450 for the year.

Here's what your monthly repayments could look like. If you're self-employed, use this as a guide to how much you should be putting away for your annual tax return:

| Annual salary | Plan 1 monthly repayments (6th April 2023 – 5th April 2024) |

|---|---|

| £22,015 | £0 |

| £25,000 | £22 |

| £30,000 | £60 |

| £35,000 | £97 |

| £40,000 | £135 |

| £45,000 | £172 |

| £50,000 | £210 |

Student Loan repayments come with weekly and monthly thresholds, too. This means that even if you have a salary that falls below the annual threshold, receiving a bonus or completing extra shifts could mean you end up crossing the threshold and making a Student Finance repayment.

However, if at the end of the financial year (which runs from April to April) your annual earnings are still below the annual repayment threshold, you'll be entitled to a refund. Head over to our guide to Student Loan refunds to find out how to go about claiming your money back.

When are Plan 1 Student Loans written off?

If you started studying in the 2005/06 academic year or earlier, your Plan 1 Student Loan will be written off when you turn 65. If you started uni in the 2006/07 academic year or later, your Plan 1 Student Loan will be written off after 25 years.

Note that when we say "after 25 years", this refers to the amount of time since the first April after you graduated (i.e. when you first became eligible to repay your Student Loan).

And if the loan is 'written off', that means you no longer have to make repayments towards it – even if you haven't paid it all back.

Plan 1 loans can also be written off if you receive a disability-related benefit meaning you can no longer work (or if you die, which you hopefully won't).

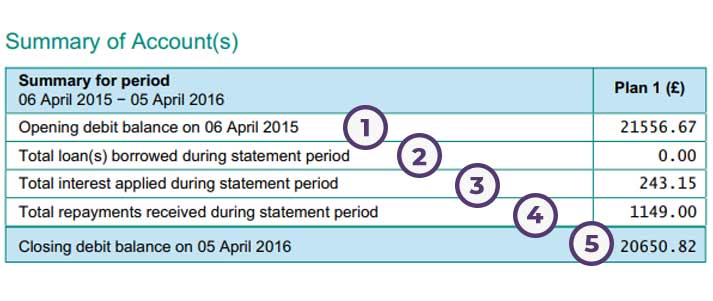

What does your Student Loan statement mean?

We've numbered the statement above in order to explain what each part means. This student has already graduated and is most likely a few years into making repayments by this stage.

Their statement shows what happened in the financial year of April 2015 – April 2016.

-

Opening balance

This amount is the total loan that the graduate started with at the beginning of this statement period. This will be the total amount they borrowed plus interest, minus any repayments (if any have been paid).

If this graduate were to look at the closing balance on their previous Student Loan statement (for the financial year April 2014 – April 2015), it would be the same amount as the opening balance here (£21,556.67).

-

The total loan(s) borrowed

Obviously, this student has already completed their studies. So, during the period that this statement covers, they won't have borrowed any extra money. See our breakdown of a Plan 2 statement to see how it may have looked if this summary covered the time this graduate was at university.

-

Total interest applied

The interest applied (£243.15) is explained above as well as in our guide to Student Finance.

For reference, the interest rate on Plan 1 Student Loans for the first few months of this statement period (April – August 2015) was 1.5%, dropping to 0.9% from September 2015 – April 2016.

-

Total repayments

During the year (6th April 2015 – 5th April 2016) this graduate will have paid back 9% of anything they earned over £17,335 (the repayment threshold at the time, which goes up every year).

This statement shows repayments of £1,149 (9% of £12,766), meaning we can assume that they were on a wage of £30,101 (the threshold plus £12,766) during that year.

-

Closing balance

This is calculated by adding the opening balance (or the amount borrowed if this is your first statement since graduating) and the interest applied during the statement period, and then subtracting the total repayments in the statement period.

So, in this instance, you'd take the opening balance (£21,556.67) and add the interest applied (£243.15), giving you £21,799.82. You'd then subtract the total repayments made during the statement period (£1,149), and you're left with £20,650.82 – the closing balance.

Plan 2 Student Loans explained

It's easy to argue that students who took out loans after 2012 in England and Wales get the rough end of the deal. Not only do they pay more in fees, but they can also be charged much more in interest.

But with a higher repayment threshold comes lower monthly payments. And when you consider that the debt on a Plan 2 loan is cancelled after 30 years, it becomes evident that it's not quite as simple as "your debt is bigger so you've got to repay more".

Keep in mind that if you're an undergraduate student from England and you're taking out a loan on or after 1st August 2023, your loan will be a Plan 5 loan.

What are the interest rates on Plan 2 Student Loans?

Confusingly, interest rates for Plan 2 loans can vary quite a bit. It usually varies by two different types of circumstances, but note that in 2022/23 things have changed again.

Plan 2 interest rates while you're studying

While studying, and until the April after you've left your course, the interest rate on your Student Loan is usually RPI plus 3%.

The RPI rate is generally set every September using the rate from March of the same year. RPI in March 2023 was 13.5%, so from September 2023 – August 2024, your Student Loan would have been set to accrue interest at a rate of up to 16.5%.

However, due to something called the Prevailing Market Rate, Plan 2 loan interest was 7.3% from September – November and 7.5% in December 2023. In January 2024, it increased further to 7.6%.

Remember, this figure normally changes every September, but market rates could change or RPI could decrease, causing the government to likely revert to that measure of interest.

Plan 2 interest rates once you've graduated

After graduating, the interest rate on your Student Loan is usually* set at RPI plus anything from 0% – 3% depending on your earnings:

- If you earn £27,295 or less, the interest rate is just RPI

- If you earn over £27,295 it's RPI plus a percentage of up to 3%. This added percentage will start low and rise in line with whatever you're earning. It stops increasing when you start earning more than £49,130, at which point it's capped at 3%.

As an example, if you earn £38,213 (approximately halfway between £27,295 and £49,130) the interest applied to your loan that year would be RPI plus 1.5% (1.5% being half of 3%).

This means that the higher your income, the more interest will be added to your loan until you pay it off.

*Plan 2 interest rates in 2023/24

In 2023/24 (as was also the case in 2022/23) the government is temporarily changing the way interest is added to Plan 2 loans in a bid to limit the effects of rising inflation in the UK.

As we mentioned above, instead of the interest rates changing based on your student status or salary, a maximum of 7.6% will be applied to everyone in January 2024.

How much are Plan 2 Student Loan repayments?

You will only start making Student Loan repayments from the April after you've graduated. Even then, you'll only have to start repaying if you're earning over the threshold.

The Student Loan repayment threshold for Plan 2 loans is £27,295/year (£2,274/month or £524/week) before tax. If you earn less than that in taxable income (wages, freelancing, tips etc.), you won't pay a penny towards your loan until you're back above the threshold.

Once you earn more than the threshold, repayments kick in and you pay 9% on the amount over £27,295. So if you earn £31,295, you'll pay 9% of £4,000 – which is £360/year.

Here's what your monthly repayments could look like. If you're self-employed, use this as a guide to how much you should be putting away for your annual tax return:

| Annual salary | Plan 2 monthly repayments (6th April 2023 – 5th April 2024) |

|---|---|

| £27,295 | £0 |

| £30,000 | £20 |

| £35,000 | £58 |

| £40,000 | £95 |

| £45,000 | £133 |

| £50,000 | £170 |

Because repayments come with monthly and weekly limits as well as an annual figure, you could find that a bonus or an extra shift pushes you above the threshold temporarily. Don't worry – if your income drops after that, your repayments will too (contact the Student Loans Company if not).

If your income rises above the monthly equivalent of a £27,295 salary (£2,274 before tax) in a given month, but across the year you earn less than £27,295, you can get these repayments back. Check out our guide to claiming a Student Finance refund for more on this.

When are Plan 2 Student Loans written off?

Plan 2 loans are written off 30 years after you first become eligible to repay (the first April after you graduate), or if you receive a disability-related benefit and can no longer work (or if you die, but let's keep this light).

If the loan is 'written off', that means you no longer have to make payments towards it – even if you haven't paid it all back!

Find out how much of your loan you're in line to repay with our Student Loan repayment calculator.

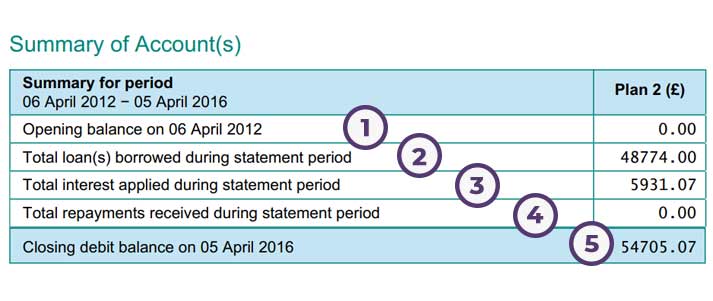

What does your Student Loan statement mean?

Every so often the Student Loans Company send out a Student Loan statement to every student/graduate, and we receive loads of worried emails and messages.

There are a lot of scary (big) numbers on the statement, as well as a lot of confusion about what it all means. Here's our breakdown to put you at ease:

We've numbered the statement above to help explain what each part means.

As this statement runs from April 2012 to April 2016, we can assume that this student started a three-year course in 2012 and graduated in 2015. In the year or so after graduating, you'll likely receive a Student Loan repayment statement very similar to this one.

-

Opening balance

This student didn't start studying until September 2012, so in April of that year, the opening balance would have been £0.

On the next statement (covering April 2016 – April 2017) the opening balance will have been the closing balance from this statement (which is £54,705.07).

-

The total loan(s) borrowed

£48,774 was the total borrowed over the three years of study, but this number could be much more or less for you depending on where you studied, what your household income was, and so on.

Remember that this figure excludes interest, so we can assume that this student borrowed £9,000/year to pay for three years of tuition fees (this is how much they cost at the time) and an average of £7,258/year in the form of a Maintenance Loan to cover living costs.

This was the first statement this person received since graduating, meaning it covers the entire period from when they started studying to when they finished. In future, the number will be £0, as the student has graduated and won't be borrowing any more money.

-

Total interest applied

Alongside the total amount borrowed, this is perhaps the scariest number for most students. The interest applied is explained above as well as in our guide to Student Finance.

We can see that the interest applied while this student was at uni isn't far off an extra year of Maintenance Loan, and this is something that many students will see on their Student Loan statement. The good news is that, in reality, there's no reason to let this number worry you too much.

Remember that the interest has no bearing on how much you repay. You always pay 9% of your earnings over the repayment threshold, no matter how large your debt or interest amount is!

As such, the majority of graduates (except for very high earners) with Plan 2 loans won't pay them back in full before they're wiped after 30 years. If we take an extreme (and basically impossible) example, the interest added to your loan could be £50 million, but you'll still only repay 9% of your earnings above a threshold, and the loan will still be cancelled after 30 years.

-

Total repayments

As we know, graduates pay back 9% of anything they earn over £27,295 from the April after they graduate.

However, prior to April 2018, this threshold was £21,000 (full list of historical Student Loan repayment thresholds).

This statement is from before April 2018 and is showing repayments of £0. While this graduate may well have been earning over the then-threshold of £21,000, they weren't eligible to make repayments until April 2016.

Unless they were earning over £21,000 AND were paid in the first five days of April (unlikely, as companies tend to pay their employees at the end of a month), there was no way this graduate could have repaid a penny during this statement period. So, it reads £0.

-

Closing balance

This is calculated by adding the total amount borrowed and the interest, and then subtracting the total repayments.

Just as you shouldn't let the interest get you down, this amount is largely irrelevant to most graduates as there's a good chance you'll never pay it all back.

Plan 4 Student Loans explained

In April 2021, a new type of Student Loan repayment plan was introduced: Plan 4.

This plan is exclusive to Scotland. Any Scottish students who started a degree in the UK on or after 1st September 1998 have now been moved to Plan 4. This also includes EU students who started a degree in Scotland in or before the 2020/21 academic year.

Anyone with a Plan 4 loan would previously have been repaying under Plan 1. The only difference is that the threshold for repayment is significantly higher – great news for Scottish students and graduates.

What is the interest rate on Plan 4 Student Loans?

As we explained above, Scottish students used to repay their Student Loans under Plan 1. As part of the move to Plan 4, most of the key components were retained – including the way interest is calculated.

This means that, like Plan 1, the rate at which Plan 4 Student Loans accrue interest is usually set in September of each year, and is determined by whichever is lowest between:

- The RPI rate from March of the same year

- The Bank of England base rate plus 1%.

You can jump back to Plan 1 for a more detailed explanation of how the interest works. But, the key point to bear in mind is that the Bank of England base rate (5.25%) plus 1% (so 6.25%) is currently lower than the RPI rate from March 2023 (13.5%).

Therefore, the interest rate on Plan 4 Student Loans is 6.25% – and that applies whether you're still studying or have graduated.

How much are Plan 4 Student Loan repayments?

Credit: Henning Marquardt - Shutterstock

You'll only start making Student Loan repayments once two things have happened: you've reached the April after you've graduated and you're earning over the threshold.

If you're on Plan 4, your Student Loan repayment threshold it's £27,660/year (£2,305/month or £532/week) before tax. If you earn less than that in taxable income (wages, freelancing, tips etc.), you won't pay a penny towards your loan until you're back above the threshold.

If you've already graduated, though, it's worth remembering that prior to April 2021, Plan 4 loans were actually Plan 1. As such, if you're looking back through old payslips, you may need to refer to Plan 1 thresholds from the past.

But whatever the threshold is, you'll only ever repay 9% of your earnings over that amount. Right now, the threshold for Plan 4 loans is £27,660, which means if you earn £32,660 a year, you'll repay 9% of £5,000 (the difference between your earnings and the threshold) – a sum total of £450 a year.

Here's what your monthly repayments could look like. If you're self-employed, use this as a guide to how much you should be putting away for your annual tax return:

| Annual salary | Plan 4 monthly repayments (6th April 2023 – 5th April 2024) |

|---|---|

| £27,660 | £0 |

| £30,000 | £18 |

| £35,000 | £55 |

| £40,000 | £93 |

| £45,000 | £130 |

| £50,000 | £168 |

Because repayments come with monthly and weekly limits as well as an annual figure, you could find that a bonus or extra shift pushes you above the threshold temporarily. Don't worry – if your income drops after that, your repayments will too (contact the Student Loans Company if not).

If your income rises above the monthly equivalent of a £27,660 salary (£2,305 before tax) in a given month, but across the year you earn less than £27,660, you can get these repayments back. Check out our guide to claiming a Student Finance refund for more on this.

When are Plan 4 Student Loans written off?

If you started studying in the 2006/07 academic year or earlier, there are two possible dates on which your Plan 4 loan could be written off. It will be whichever comes first between:

- You turning 65 years old

- Reaching 30 years after you first become eligible to repay (the first April after you graduate).

If you started studying in the 2007/08 academic year or later, things are a little more simple. Your loan will be written off 30 years after the first April following your graduation.

In either case, your loan may be written off earlier than this if you receive a disability-related benefit and can no longer work (or if you die, but let's keep this light).

And to clarify, if the loan is 'written off', that means you no longer have to make payments towards it – even if you haven't repaid it in full.

Find out how much of your loan you're in line to repay with our Student Loan repayment calculator.

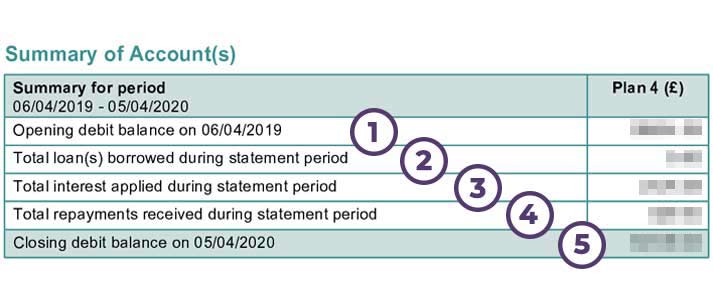

What does your Student Loan statement mean?

Every year or so you'll get a Student Loan statement sent to you from the Student Loans Company.

There are a lot of scary (big) numbers involved on the statement, as well as a lot of confusion about what it all means. Here's our breakdown to put you at ease:

IMPORTANT: At the time of writing, we didn't have access to a Plan 4 Student Loan statement. Instead, we've used a Plan 2 statement, written Plan 4 on it and blurred out the amounts as they'll likely be very different to what you'll see on yours. But the key thing to remember is that the layout will be the same.

Bearing that in mind, let's run through each part of your Student Loan statement:

-

Opening balance

The opening balance is the amount of money you owed at the start of the statement period (usually the start of the financial year, which always runs from 6th April to 5th April).

This amount is the combined total of any Tuition Fee and Student Loans you've taken out, plus any interest that has been applied in previous statement periods. The opening balance on a statement is always the same as the closing balance from the previous statement.

If you're receiving your first statement since graduating, the statement period will likely start at the beginning of the financial year you started uni in, and finish at the end of the financial year you graduated in.

So, if you started in September 2016 and graduated in September 2019, the statement would run from April 2016 to April 2020. In this case, your opening balance would be £0. See our Plan 2 statement explanation for an idea of how this would look.

-

The total loan(s) borrowed

This section refers to the amount of money you've borrowed during the statement period. If you're receiving your first statement since graduating, this row will show your entire Student Loan (minus interest). You can revisit our Plan 2 statement explanation to see what this would look like.

If this is at least your second Student Loan statement since graduating, this row will show a balance of zero, as you've not borrowed any extra money during the period it covers.

-

Total interest applied

While Plan 4 loans have a lower interest rate than those on Plan 2, you may still wince at the sight of even more money being added to your debt. This will especially be the case if it's more than the amount you've managed to pay off during the same period.

However, the good news is that, as with Plan 1 and Plan 2 loans, there's no reason to let this number get you down.

Regardless of the size of your debt, you will only ever repay 9% of your earnings over the threshold (currently £27,660/year). In fact, to put things into context, an extra £1 million of interest could be added to your debt every year and it still wouldn't change the size of your monthly repayments.

All the interest does is increase the time it'll take you to repay your loan in full. But, of course, this also increases the chance of it being written off before you've cleared the balance. This is something which became even more likely when Scottish students moved to the higher repayment threshold of Plan 4.

-

Total repayments

The total repayments made during the statement period should be 9% of your earnings over the threshold applicable at that time.

From 6th April 2023 – 5th April 2024, the repayment threshold for Plan 4 loans is £27,660, so you'll only make repayments on anything you earn above that.

In the previous financial year, the threshold was £25,37. However, prior to 6th April 2021, Plan 4 loans were part of Plan 1, so were subject to these thresholds which changed each year.

So, if you're looking at a repayment statement that includes any time before April 2021, remember that the repayment threshold was significantly lower than it is now. As such, repayments would have kicked in when you were earning much less.

-

Closing balance

This is calculated by adding the opening balance (or, if this is your first statement since graduating, the amount borrowed) and the interest applied during the statement period, and then subtracting the total repayments made during the same time.

Obviously, we've blurred out the figures here so we can't run through this specific example. But, you can check out our Plan 1 and Plan 2 statements to see how it works in practice.

Plan 5 Student Loans explained

If you're from England and are starting your degree on or after 1st August 2023, your loan will be on Plan 5.

This only applies to students from England, but it comes with quite a few changes compared to Plan 2. Read on to see what this means for you.

What is the interest rate on Plan 5 Student Loans?

The interest rate for Plan 5 loans is usually based on the RPI rate (a measure of inflation) both during and after university.

However, there is currently a Prevailing Market Rate which reduces the cap on interest rates due to the recent high levels of inflation.

Plan 5 interest rates

The RPI rate is generally set each September using the rate from March of the same year. RPI in March 2023 was 13.5%. As such, from September 2023 to August 2024, your Student Loan would have been set to accrue interest at a rate of up to 13.5%.

However, due to the Prevailing Market Rate, this figure was 7.3% from September to November and 7.5% in December 2023 for all Plan 5 loans. In January 2024, the interest rate is 7.6%.

Remember, this figure normally changes every September, but market rates could change or RPI could decrease, causing the government to likely revert to that measure of interest.

How much are Plan 5 Student Loan repayments?

Similar to the other plans, you only start repaying your Student Loan once you've left your course and are earning above a certain threshold.

The repayment threshold for Plan 5 loans is currently £25,000/year (£2,083/month or £480/week) before tax.

Once you earn more than the threshold, you start repaying. However, you only pay 9% of the amount above the threshold. For example, if you earn £30,000/year (£5,000 above the threshold), you will pay 9% of £5,000 for the year, which is £450.

Here's what your monthly repayments could look like. If you're self-employed, use this as a guide to how much you should be putting away for your annual tax return:

| Annual salary | Plan 5 monthly repayments (6th April 2026 – 5th April 2027) |

|---|---|

| £25,000 | £0 |

| £30,000 | £38 |

| £35,000 | £75 |

| £40,000 | £113 |

| £45,000 | £150 |

| £50,000 | £188 |

As Plan 5 Student Loans are being introduced in August 2023, the first repayment will be no earlier than the 2026/27 tax year.

Student Loan repayments also come with weekly and monthly thresholds. If you have a salary that falls below the annual threshold, it could mean that you end up crossing the threshold if you receive a bonus or take on extra shifts. If that happens, you will have to start repaying your Student Loan.

However, if at the end of the financial year (which runs from April to April) your annual earnings are still below the annual repayment threshold, you'll be entitled to a refund. Head over to our guide to Student Loan refunds to find out how to go about claiming your money back.

When are Plan 5 Student Loans written off?

This is one of the biggest changes compared to other plans. If you have a Plan 5 Student Loan, it will be written off 40 years after you're due to start making repayments.

This is a lot longer than other plans, so a bigger proportion of students on this plan are likely to pay off their Student Loans in full.

If the loan is 'written off', that means you no longer have to make repayments towards it – even if you haven't paid it all back.

What happens to your Student Loan if you move abroad?

There are no fees for taking out a Student Loan, but penalty charges will kick in if you try to avoid paying what you owe. The idea that you can ditch your loan by emigrating is just one of the many urban myths about tuition fees.

In reality, Student Finance will find you and make you pay.

The short story is that Student Loans are fairly flexible. You don't pay if you don't earn enough, and you can overpay whenever you want. But you can't skip repayments if you're earning enough to be making them, no matter where you are in the world.

Should you pay off your Student Loan early?

If you're thinking ahead, you may have realised that when you're old enough or earning enough to be thinking about kids, cars and mortgages, you'll also be making bigger Student Loan repayments.

As a result, you might assume that it's better to pay off your loan ASAP – but hold fire! Here are a few things to consider if you're considering paying off your Student Loan early:

-

Your Student Loan could get written off before you're done paying

We can't stress it enough: very few students will ever pay back the full amount that they owe – especially if you have a Plan 2 loan.

If there's even a half-decent chance of your loan being wiped before you've cleared it, you could be throwing money away if you make extra voluntary repayments.

You can never predict exactly how much you'll earn in the future. But, there are some useful rules of thumb. If you have the qualifications and drive to pursue a very high-paying career, paying off your loan early could save you money (as the interest will have less time to accrue).

If not, don't put any spare cash towards extra Student Loan repayments. Put it to better use by building your own savings pot elsewhere.

-

Student Loan repayments are manageable

Right at the top of this guide, we said that the Student Loan is one of the better borrowing deals out there. And we stick by this.

If the loan had come from a commercial or private lender, you could be landed with big fat arrangement fees, hefty penalties for missing repayments, as well as sky-high interest rates.

Banks and commercial lenders would also expect to get paid no matter how little you earn, whereas Student Loan repayments are based entirely on what you can actually afford.

All this adds up to make the repayments so manageable that most graduates don't even miss the cash that comes out of their monthly pay to cover it.

-

You can put your cash to better use

You'll probably never have repayment terms like this again, so the key is to make the most of them.

Rather than using any extra cash you have to pay your loan off early, you could make it grow in a savings account, invest it or even put it towards a mortgage.

The Student Loan is the least pressing of all debts. So, you'd be better off using any additional cash to help pay off more expensive debts like credit cards or commercial loans.

-

You can't get voluntary Student Loan repayments back

If you're charged more than you should be for your income, you can ask for a refund (call SLC on 0300 100 0611).

But if you choose to overpay, you can't get the cash back if you change your mind. It also makes no difference to the size of your monthly repayments, as they're based on your current income, not what you owe.

Imagine you overpay, but later find yourself skint and needing to borrow more money from another lender. It'll probably cost you much more than what you've saved on your Student Loan.

In short: be very sure you won't need the cash again before overpaying!

-

Student Loans don't affect your credit score

As we said earlier, your Student Loan won't affect your credit score. However, what it can have an impact on is your affordability check.

An affordability check is carried out by a mortgage lender in addition to a credit check. It's designed to assess how much you can realistically afford to pay each month. They look at your incomings and outgoings, and as your Student Loan is a regular outgoing, it'll leave you with less money to spend each month.

That said, the impact of your Student Loan on an affordability check will be minimal as the repayments are such a small percentage of your overall income.

-

Student Loan repayment terms aren't set in stone

We keep banging on about this, but it bears repeating: Student Finance terms aren't set in stone.

This is pretty much the only argument in favour of making additional Student Loan repayments. While the terms are decent enough right now, they can change at any time. And, should they change for the worse, you could later regret not clearing your debt earlier.

5 things to do BEFORE repaying your Student Loan

Here's everything you should do before you start repaying your Student Loan:

- Check your statement and make sure you haven't been wrongly over-charged. If you have, ask for a Student Loan refund (and put the money to better use, in a savings account for example).

- Get to grips with tax (our simple guide to taxes can help) because only taxable income counts towards the loan threshold.

- Squirrel money away independently instead. Look for savings rates higher than the loan interest and max out your allowances (don't forget any tax-free allowances, too).

- Start saving for a mortgage or pension. They might seem years away but the earlier you start, the less you have to put away each month to hit the same pay-off.

- If you've got more expensive debts (like credit cards, private loans and payday loans), compare any fees for overpaying and think about paying them off first if it saves you money in the long run.

If you're not sure which option is best for you, or you're struggling to get your head around the sums, ask for help. Try your university's student money adviser or look for an independent financial adviser.

Check if you have overpaid your Student Loan

As most Student Loan repayments are automatic, it is possible to accidentally overpay.

There are different reasons why you may have overpaid, so there are different ways to check if you overpaid.

We go through some of the reasons why you might have overpaid in our guide to Student Loan refunds for overpayments.

One example is that you shouldn't start paying back your Student Loan until the April after you graduate. If you have, it could be the case that you've started making repayments too early. It's best to check your payslips for this.

Or, you might have also overpaid if you've made repayments before reaching the income threshold. Again, keep an eye on your payslip for this.

And if you think you've been put in the wrong Student Loan repayment plan, talk to your employer.

Overpayments can also happen when you've already paid off your entire loan, if repayments continue to get taken out of your salary.

To avoid this, it can help to switch to Direct Debit when you're in the last two years of repaying your Student Loan. This way, your repayments go directly to SLC so they can stop them when you've paid the loan back in full.

Make sure you keep your contact details up to date so that SLC can get in touch when you're close to repaying your Student Loan.

How to get a refund

If you have paid more than you owe, SLC should try to send your refund automatically. Or, if they try to send a refund but don't have your up-to-date bank details, they'll contact you to let you know.

But if you think you have overpaid and you haven't heard from them, it's best to contact SLC.

You can do so by calling 0300 100 0611 (or 0300 100 0370 from Wales and +44 141 243 3660 from overseas) or contacting them via Twitter or Facebook. Make sure you have your payslips and P60s ready in case they need any information from them.

We have a full guide on how to get a refund if you overpaid your Student Loan for more information.

These are the facts, but what about the fiction? Allow us to debunk the Student Loan myths that so many people still believe.