Postgraduate Loans in Scotland 2024

Doing a postgraduate degree but unsure about Student Finance? Here's your complete guide to funding, completely tailored to Scottish students.

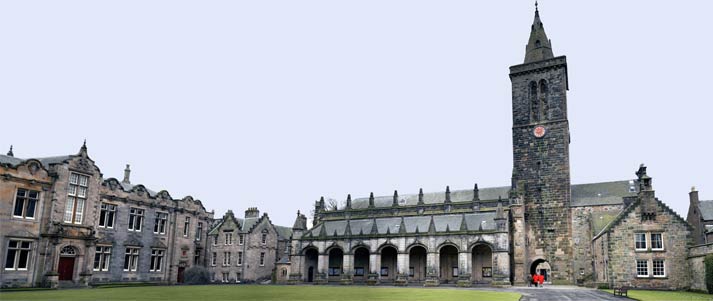

Credit: DiegoMariottini – Shutterstock

Postgraduate degrees are a great way of expanding your skillset, immersing yourself in a subject you really love and boosting your career prospects (all while avoiding the real world for just a little while longer!).

However, they do come at a price and funding isn't quite as generous as it is for undergraduate degrees. Plus, just to make things even more confusing, funding for Scottish students isn't the same as it is for students living in the rest of the UK.

If you're not sure how much things are going to cost and how you're going to cover them, we'll take you through everything from tuition fees to living costs, step-by-step.

What's in this guide?

Eligibility for Scottish Postgraduate Loans

Credit: Stu Smith - Flickr

First thing's first: the money to help you cover your postgraduate degree comes from the Student Awards Agency Scotland, which we'll refer to as SAAS from here on out.

To be eligible for a master's funding in Scotland, you must:

- Meet the residence conditions

- And be studying an eligible course.

Residence conditions

To qualify for a SAAS Postgraduate Loan, you need to have ordinarily been a resident in the UK, Channel Islands or Isle of Man for three years prior to the relevant date, and you need to be ordinarily resident in Scotland on the relevant date.

Here are the relevant dates:

- 1st August if your course starts between 1st August – 31st December

- 1st January if your course starts between 1st January – 31st March

- 1st April if your course starts between 1st April – 30th June

- 1st July if your course starts between 1st July – 31st July.

If you are not a UK national, you must be settled in the UK, with official settled status, on the relevant date.

What this means is that you cannot just move to the UK/Scotland for your education to receive the funding – you have to be living there anyway.

If you don't meet the residence conditions above, there are some exceptions which mean you could still be eligible for a Postgraduate Loan in Scotland, including:

- Asylum seekers with leave to remain in the UK

- UK nationals who were born and have spent the greater part of their life in the UK

- UK nationals who have returned to work or study after living in the EU

- Republic of Ireland nationals

- EEA and Swiss nationals granted permanent residence in the UK.

These are just a small handful of the exceptions.

If you're completing a postgraduate course immediately after finishing your undergraduate degree, you should apply to the same funding body (e.g. Student Finance England, SAAS, etc.) for postgraduate funding as you did as an undergraduate.

This means if you're an English student who studied in Scotland for four years, financed by Student Finance England (SFE), you will also apply to them for postgraduate funding, not SAAS.

Living in Scotland for your undergraduate degree is not classed as being 'ordinarily resident' there. However, if you graduate and work in Scotland for a few years first, this could make you eligible for SAAS master's funding.

Eligible courses

Unlike undergraduate degrees, which are a bit more straightforward, postgraduate courses come in a lot of different shapes and sizes – and not all of them are eligible for financial support.

Crucially, you need to be studying for a Postgraduate Diploma or master's level course. Examples include:

- Postgraduate Diploma (PG Dip)

- Master of Science (MSc)

- Master of Research (MRes)

- Master of Philosophy (MPhil)

- Master of Letters (MLitt)

- Master of Business Administration (MBA).

Since the 2019/20 academic year, research master's have also been eligible, but not those which are part of an integrated PhD programme.

Courses can be taught, research-based or distance learning, but there needs to be a minimum amount of contact time between you and the teaching staff – so online courses might not be eligible.

Course duration

Postgraduate Diplomas can last no longer than one year, while master's courses, including research-based ones, must be no longer than two years.

If you're studying part-time, your course must take no longer than twice the length of an equivalent full-time course at the same university to complete. If there is no full-time equivalent, the course can take no longer than three years.

So, for example, if the full-time version of your course lasts two years, you can receive postgraduate funding in Scotland for a maximum of four years if you're studying part-time.

Studying in England, Wales or Northern Ireland as a Scottish student

If you're studying in England, Wales or Northern Ireland, you might still be able to receive a SAAS Postgraduate Loan.

You need to meet the requirements outlined above (both the residence conditions and eligible course requirements) and your course must not be available in Scotland.

This basically means if you could have studied your course in Scotland but just fancied England instead, you won't be eligible for funding. But if you had no choice but to head elsewhere for the course you want to do, then you'll still get the dosh.

Finally, if you tick all the boxes, make sure you apply for your finance before the deadline.

SAAS recommended that you applied by 30th June 2023 to ensure everything is processed in time for the start of your course. However, you can usually apply long after your course has started. In fact, the actual closing date for 2023/24 funding applications is 31st March 2024.

Tuition Fee Loan for postgraduate degrees in Scotland

All eligible postgraduate students can apply for a Tuition Fee Loan of up to £7,000 from SAAS to cover course tuition fees.

All students can apply for the full amount, regardless of household income, and the money goes straight to your university or college – you won't see it at all.

However, with many full-time master's courses in Scotland costing in the region of £8,000 – £12,000, you might find the loan isn't enough. And if the cost of your course is more than the maximum loan amount, you'll have to find a way to make up the difference. We go through some additional funding options below.

If your course lasts more than one year, the loan is split evenly across each year of study.

If you have previously studied for a postgraduate qualification, with financial support from UK or EU public funds, then you may not be eligible for the Tuition Fee Loan. However, you will still be able to apply for the Living Cost Loan.

Living Cost Loan for postgraduate study in Scotland

You can apply for a Living Cost Loan of up to £4,500, which is not income-assessed.

The loan is split across each year of study if your course lasts longer than a year. So, for a full-time two-year course, you would receive up to £2,250 a year to cover your living costs.

The Living Cost Loan is available to any student on an eligible postgraduate course who meets the residence criteria.

It is not available to students studying part-time or to Irish students in Scotland.

The main problem with the Living Cost Loan is that, ironically, it probably won't be enough to cover your living costs. In fact, you'll be lucky if it even covers your rent for the year.

Therefore, even if you are eligible for the loan, you'll need to think about using a part-time job or some savings to top up your income. We've also listed some other funding sources for postgraduate students below.

Have a look at the average student living costs, including the average cost of rent at each university in the UK, for an idea of how much money you'll need.

Repaying your Postgraduate Loan

Now the scary part – paying all the money back. What most students don't realise, however, is that it's not scary at all, and loan repayments are manageable.

Here's an overview of key things to remember about Postgraduate Loan repayments in Scotland:

- You don't start repaying your Student Loan until the April after you graduate.

- You will repay 9% of any income you make over £27,660 a year.

- If you already have a Scottish undergraduate loan, your Postgraduate Loan debt will simply be added to this. Each month, you'll make a combined repayment to them both (rather than two separate payments) that is no larger than it would be if you just had an undergraduate loan. If you have an undergraduate loan from elsewhere in the UK, you'll repay that separately.

- The money will be automatically deducted from your pay each month – look out for it on your payslip. If you're self-employed, it will be deducted through your self-assessment tax return.

- If you're working and living abroad, you'll have to make alternative arrangements to pay.

- The interest rate currently stands at 6.25%.

- You can make extra repayments in order to pay the loan off quicker. However...

- The loan will be written off after 30 years. Any debt that is still left to pay back at that point will be wiped.

The table below gives you an idea of how much you'll be paying back depending on your salary:

Monthly repayments for the Postgraduate Loan in Scotland

| Annual salary | Plan 4 monthly repayments (6th April 2023 – 5th April 2024) |

|---|---|

| £27,660 | £0 |

| £30,000 | £18 |

| £35,000 | £55 |

| £40,000 | £93 |

| £45,000 | £130 |

| £50,000 | £168 |

Other funding sources for postgraduate study

Credit: TierneyMJ – Shutterstock

If you're not eligible for the funding outlined above or don't think it's enough to cover your costs, then all hope is not lost! These are some of the alternative postgraduate funding sources we recommend checking out:

-

Discretionary funds

Universities receive discretionary funds from the Scottish government to help students who either have financial difficulties while studying, or who are struggling to start the course due to financial reasons.

Universities usually decide who they give this money to, and how much they give, based on who needs it most. Importantly, however, to be eligible for this money you must also meet the residency requirements and have applied for the maximum Student Loan you are entitled to.

Therefore, this funding is best for students who need extra support on top of the Tuition Fee Loan and Living Cost Loan if they find it doesn't stretch far enough.

-

Disabled Students' Allowance (DSA)

If you have a disability, learning difficulty or health problem (mental or physical) that affects your ability to study, you may be able to receive funding.

Like all the other funding options on this page, you can receive the Disabled Students' Allowance (DSA) as a postgraduate student, regardless of your household income. For more info, check out our dedicated DSA guide.

-

Childcare funds

This is money the Scottish government provides to help students cover the costs of childcare while studying, including childminders, after-school clubs and daycare. Universities receive this money and then decide who to award it to (and how much to give), so you'll have to apply through your institution.

You need to be studying on a full-time course and be eligible for the Tuition Fee Loan in order to receive this money.

-

Grants, bursaries and scholarships

Since funding for postgraduate study isn't as straightforward and freely available as it is for undergraduates, there are more grants, bursaries and scholarships out there. This is basically free money that you don't have to give back, but competition for it can be tough.

Check out this list of bursary and scholarship sources for more information on where to look for funding and how to get your mitts on it.

You might also come across adverts for private student loans, but we recommend only taking these out as a last resort.

Our guide to quick money makers should help you edge towards fully funding your master's.